Capital Allowance For Motor Vehicle Malaysia

In malaysia for at least 182 days in a calendar year.

Capital allowance for motor vehicle malaysia. 50k for car costing above 150k. The total capital allowances of such assets are capped at rm20 000 except for smes as defined. Capital allowance for personal cars are. This is only for passenger car.

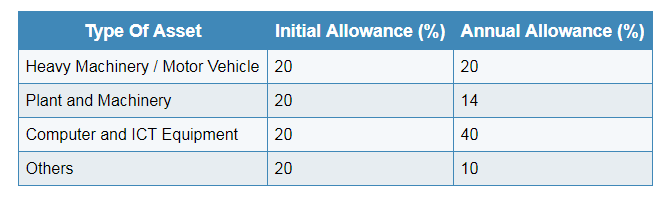

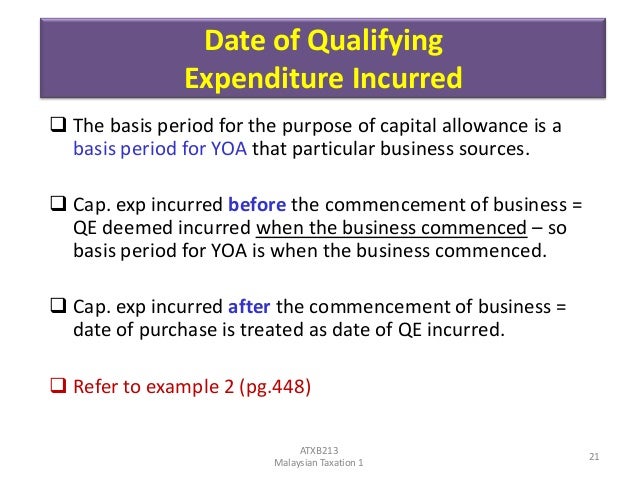

20 20 20 20 accelerated capital allowance aca on machinery and equipment. Computation of capital allowances and balancing charge. The purpose of capital allowance is to give a relief for wear and tear of fixed assets for business. Rm50 000 rm100 000 applies only to new vehicle with total cost not exceeding rm150 000 purchased on or after 28 oct 2000.

Business loss for the year of assessment 2016 capital allowances b f and current year capital allowances on other assets were rm160 000 rm30 000 and rm55 000 respectively. 27 august 2015 page 4 of 22 5 2 vehicle a qe for a vehicle licensed for commercial transportation of goods or passengers is the cash price of the vehicle including basic. Capital allowances tax incentives income exempt from tax double tax treaties and withholding tax rates real property gains tax stamp duty sales tax service tax. Motor vehicle is 20 aa and 20 ia.

The value of the asset is increased from rm1 300 to rm2 000 and the total capital allowances capped is increased from rm13 000 to rm20 000 w e f. Allowance annual allowance qualifying expenditure on private motor vehicles restricted to. Small value assets not exceeding rm2 000 each are eligible for 100 capital allowances. 100k for car costing below 150k.

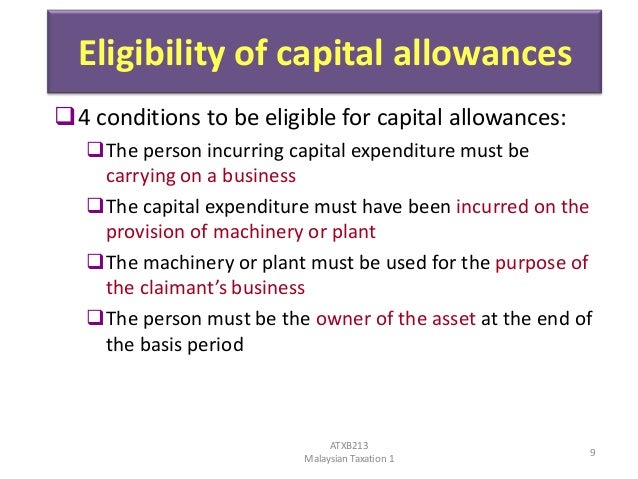

6 2015 date of publication. In malaysia for a period of less than 182 days during the year shorter period but. Rm rm year of assessment 2014 qe 200 000 ia 20 x rm200 000 40 000 aa 14 x rm200 000 28 000 68 000. Conditions for claiming capital allowance are.

Inland revenue board of malaysia computation of capital allowances public ruling no. Commercial vehicles such as lorry or van are given full capital allowances. Some examples of assets that are normally used in business are motor vehicles machines office equipments and furniture. Capital allowance is only applicable to business activity and not for individual.