Corporate Tax In Malaysia

Interest paid to a non resident by a bank or a finance company in malaysia is exempt from tax.

Corporate tax in malaysia. However from 17 january 2017 to 5 september 2017 services rendered in and outside malaysia are liable to tax. The content is straightforward. Malaysia adopts a territorial system of income taxation. See note 5 for other sources of income subject to wht.

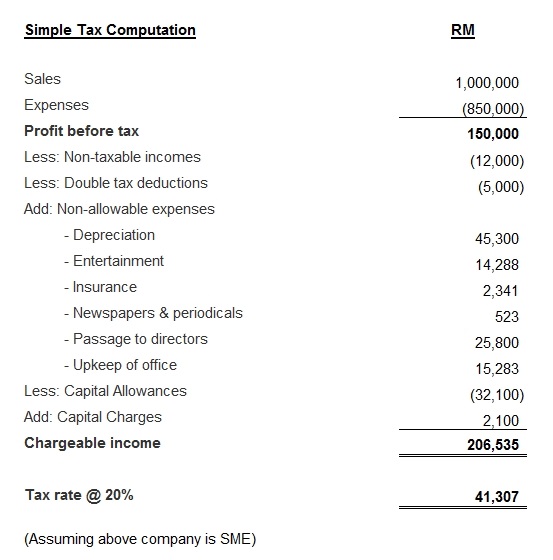

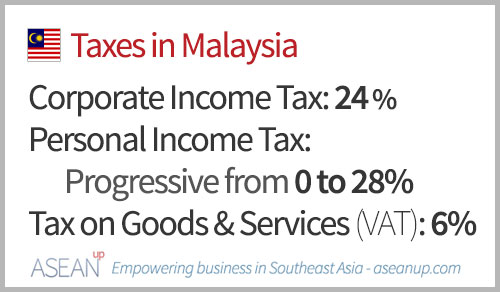

Wht dividends 1. The malaysia corporate tax rate has a standard rate as well as a smaller one applicable under certain conditions to small and medium resident companies. The corporate tax in malaysia is one of the basic income taxes that are applicable to companies and to other entities that obtain an income from the sale of services or goods. It represents a compulsory tax that is charged based on the income obtained in a financial year by a taxable entity this is why the malaysia corporate tax rate varies.

Malaysia corporate income tax rate. Corporations making payments of the following types of income are required to withhold tax at the rates shown in the table below. Only services rendered in malaysia are liable to tax. This publication is a quick reference guide outlining malaysian tax information which is based on taxation laws and current practices.

Corporate taxes on corporate income last reviewed 01 july 2020 for both resident and non resident companies corporate income tax cit is imposed on income accruing in or derived from malaysia. Income derived from sources outside malaysia and remitted by a resident company is exempted from tax. Malaysia corporate income tax guide. Corporate tax rate in malaysia averaged 26 21 percent from 1997 until 2020 reaching an all time high of 30 percent in 1997 and a record low of 24 percent in 2015.

This page provides malaysia corporate tax rate actual values historical data forecast chart statistics economic calendar and news. This tax is imposed on income that is derived from or accruing in the country both in the case of resident and non resident legal entities. These proposals will not become law until their enactment and may be amended in the course of their passage through. Malaysia corporate withholding taxes last reviewed 01 july 2020.

A company whether resident or not is assessable on income accrued in or derived from malaysia. A company or corporate whether resident or not is assessable on income accrued in or derived from malaysia. Territorial basis of taxation. Taxpayers need a current guide such as the worldwide corporate tax guide in such a shifting tax landscape especially if they are contemplating new markets.

This booklet also incorporates in coloured italics the 2020 malaysian budget proposals announced on 11 october 2019 and the finance bill 2019.