Corporate Tax Rate Malaysia 2018

4 tax information you need to know.

Corporate tax rate malaysia 2018. Malaysia has adopted a territorial system to pay corporate tax rate. On the first 5 000 next 15 000. Malaysia corporate tax rate 2018 table. Malaysia corporate tax rate 2018.

Masuzi march 12 2019 uncategorized no comments. The standard corporate tax rate of 24 for a period of five years with a possible extension for. Malaysia taxation and investment 2018 updated april 2018 1 1 0 investment climate 1 1 business environment malaysia is a federated constitutional monarchy with a. On the first 2 500.

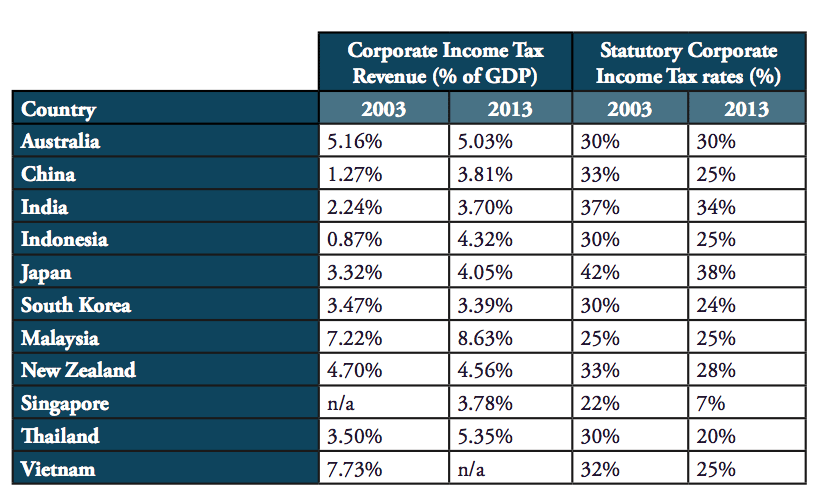

Melayu malay 简体中文 chinese simplified malaysia corporate income tax rate. An organization or corporate regardless of whether occupant or not is assessable on wage gathered in or got from malaysia. Malaysia personal income tax guide 2017 taxplanning budget 2018 wish list the edge markets. Companies incorporated in malaysia with paid up capital of myr 2 5 million or less and that are not part of a group containing a company exceeding this capitalization threshold is 18 on the first myr 500 000 with the balance being taxed at the 24 rate.

Calculations rm rate tax rm 0 5 000. Rate the standard corporate tax rate is 24 while the rate for resident small and medium sized companies i e.