Difference Between Gst And Sst In Malaysia

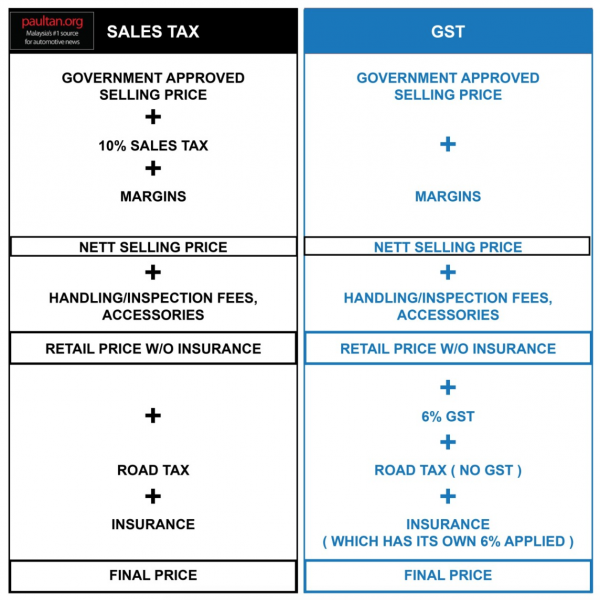

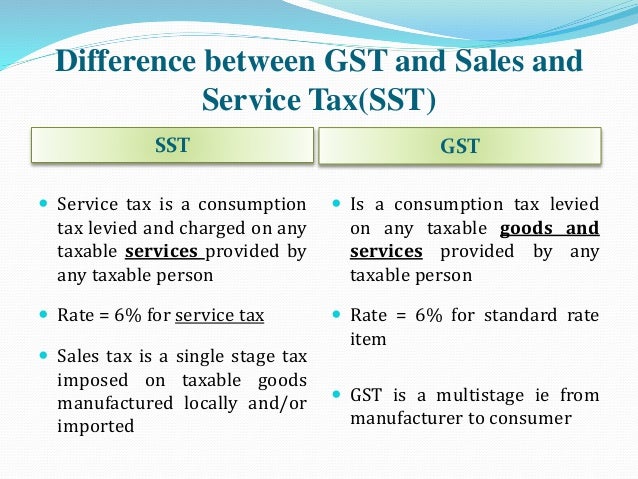

The sales tax in malaysia was a federal consumption tax that was introduced and implemented on a wide variety of goods and governed by the sales tax act 1972.

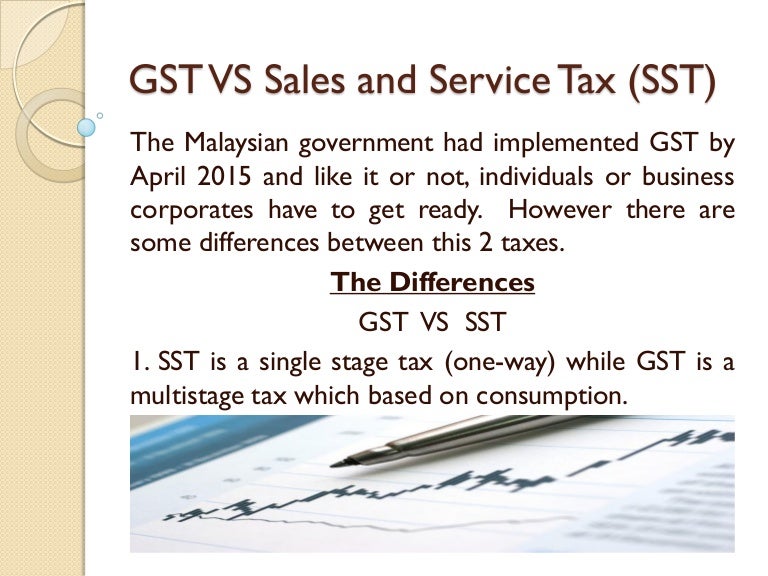

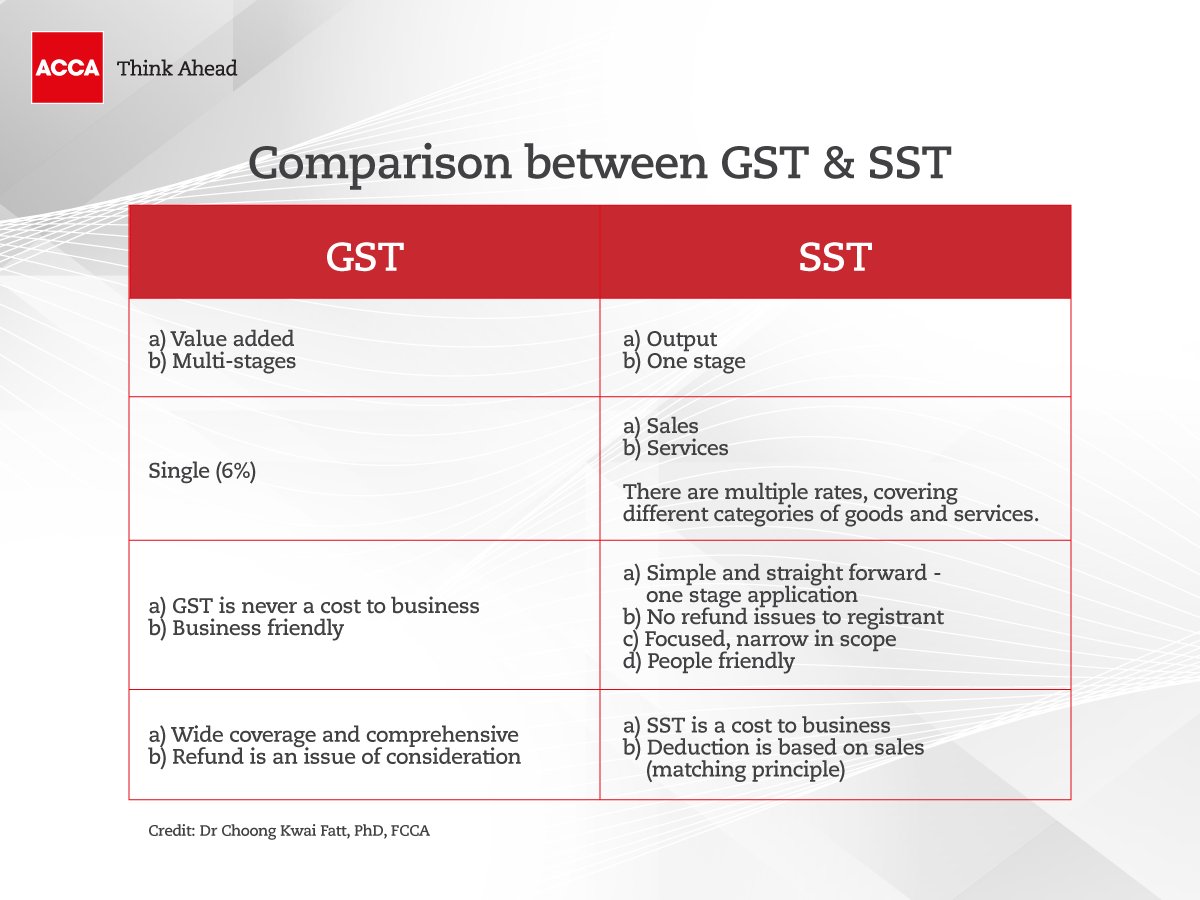

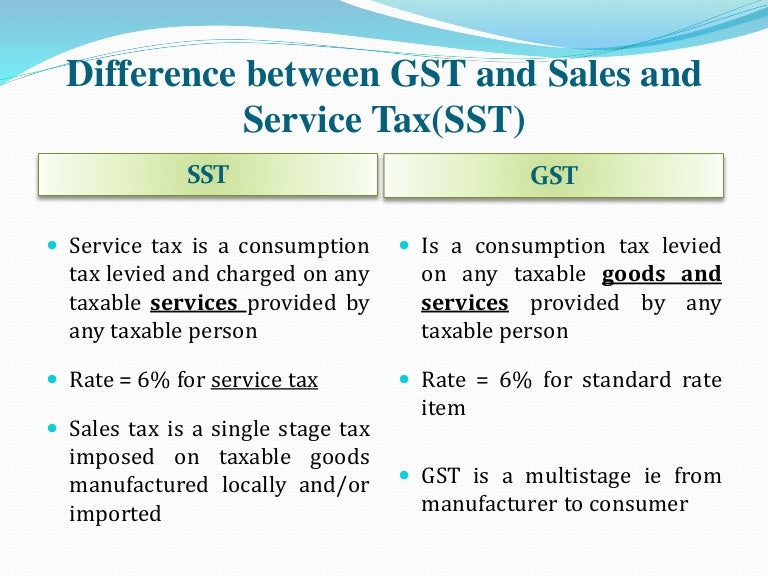

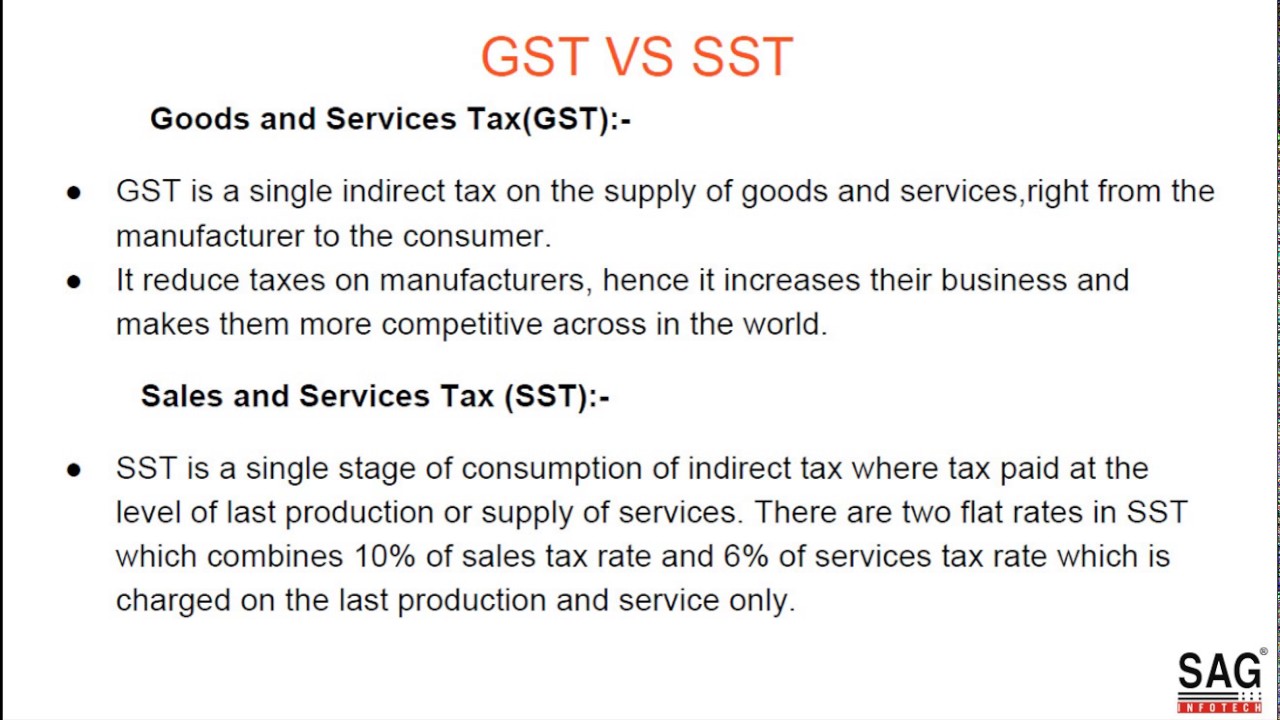

Difference between gst and sst in malaysia. The service tax was governed by the service tax act 1975 and this was also a federal consumption tax. Sst rates are less transparent than the gst which had a standard 6 rate the sst rates vary from 6 or 10. The sales and services tax sst was recently reintroduced back in malaysia as part of pakatan harapan s post election victory manifesto during ge 18. The above two differences are about the basic differences between gst and sst which is also the fundamental reason why people of our country opposed the implementation of gst in the first place.

Difference between gst and sst in malaysia before you read about the differentiations between these two policies first you should know why gst got finally obsolete in malaysia. To put it simply the sst consists of two separate taxes that are governed by two distinct tax laws on goods and services at a single stage. Sales and services tax sst the sales tax is only imposed on the manufacturer level the service tax is imposed on consumers that are using tax services. Before the sst is officially implemented take time to enjoy the honeymoon period of spending money in malaysia.