Lhdn E Filing 2020 Due Date

Additionally taxpayers will be allowed to.

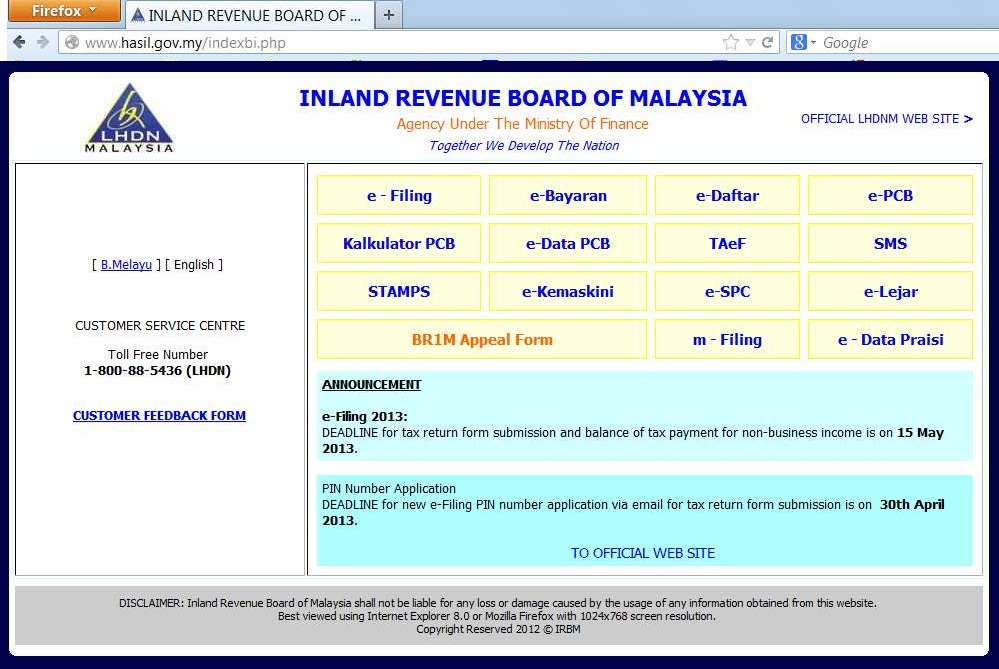

Lhdn e filing 2020 due date. Untuk makluman pengemukaan borang nyata cukai pendapatan bncp lembaga hasil dalam negeri malaysia untuk tahun taksiran 2019melalui e filling bagi borang e be b bt p mt dan tf boleh dilakukan pada tarikh yang dinyatakan dibawah. Lhdnm memohon maaf atas sebarang kesulitan yang mungkin timbul namun penyelenggaraan ini adalah perlu bagi memastikan kesinambungan penyampaian perkhidmatan kepada semua. According to lembaga hasil dalam negeri lhdn the move is meant to facilitate the submission of tax returns affected by the national movement control order which starts today. Click ezhasil and choose e filing.

Tax filing deadline extension for year 2020 updated 28 april 2020 for more information please refer to lhdn rf filing programme year 2020 amendment 3 2020 2020. 31 august 2020 lhdn. 3 anda boleh terus melawat dan akses portal rasmi lembaga hasil dalam negeri untuk memulakan proses pendaftaran sekiranya anda baru pertama kali declare cukai pendapatan anda. Malaysia dateline atau due date syarikat persendirian.

This has led to an encouraged use of online services on the lhdn website where taxpayers can file taxes and make necessary tax payments through the ezhasil and e filing system. The internal revenue board lhdn has extended the deadline for income tax form submission until the end of june 2020. Extension of filing deadline. Summary of extension due date on epf socso sst hrdf ssm irbm during movement.

This decision was made in conjunction with the restricted movement order rmo that is in place from today until 31 march 2020 due to covid 19 pandemic. 02 april 2020 khamis hingga 03 april 2020 jumaat. Lembaga hasil dalam negeri malaysia inland revenue board of malaysia. Tarikh akhir isi bagi individu.

Thus the new deadline for filing your income tax returns in malaysia via e filing is 30 june 2020 for resident individuals who do not carry on a business and 30 august 2020 for resident individuals who carry on a. Are allowable to defer the cp204 payment due on 15 04 2020 15 05 2020 and 15 06 2020 and for other company cp500 payment due on 31 03 2020 and 31 05 2020. Tarikh akhir e filling 2020 lhdn perhatian buat pembayar cukai bila tarikh akhir hantar borang cukai efilling 2020 untuk tahun taksiran 2019. Tarikh mula isi.

Two 2 months grace period from the due date of submission is allowed for those with accounting period ending 31 july 2019 until 31 august 2019. Request first time e filing pin via telephone. Form e return by employer individual income tax return no business income with business income statutory deadline march 31 2020 april 30 2020 june 30 2020 existing grace period based on method of submission electronic filing 1 month april 30 2020 15 days may 15 2020 15 days july 15 2020 via postal delivery 3 working days.