Malaysia Corporate Income Tax Rate 2018

Malaysia personal income tax guide 2017 taxplanning budget 2018 wish list the edge markets.

Malaysia corporate income tax rate 2018. Malaysia personal income tax guide 2017 taxplanning budget 2018 wish list lhdn income tax reliefs smeinfo understanding tax. On the first 2 500. This page is also available in. Rate the standard corporate tax rate is 24 while the rate for resident small and medium sized companies i e.

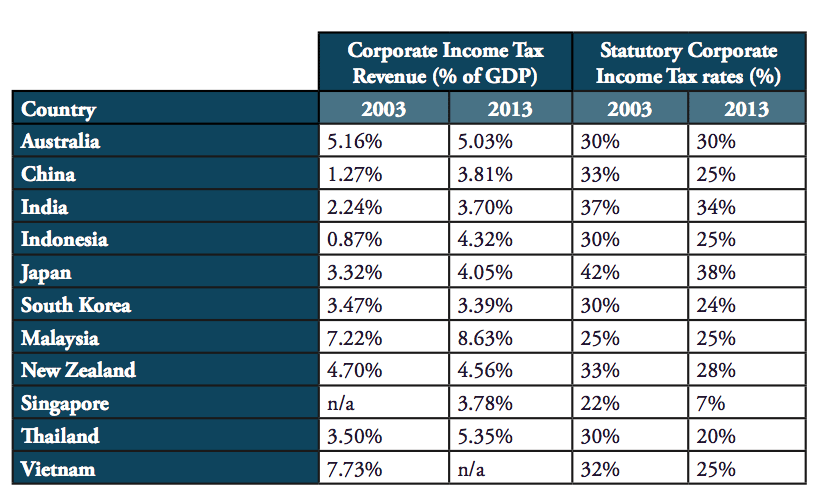

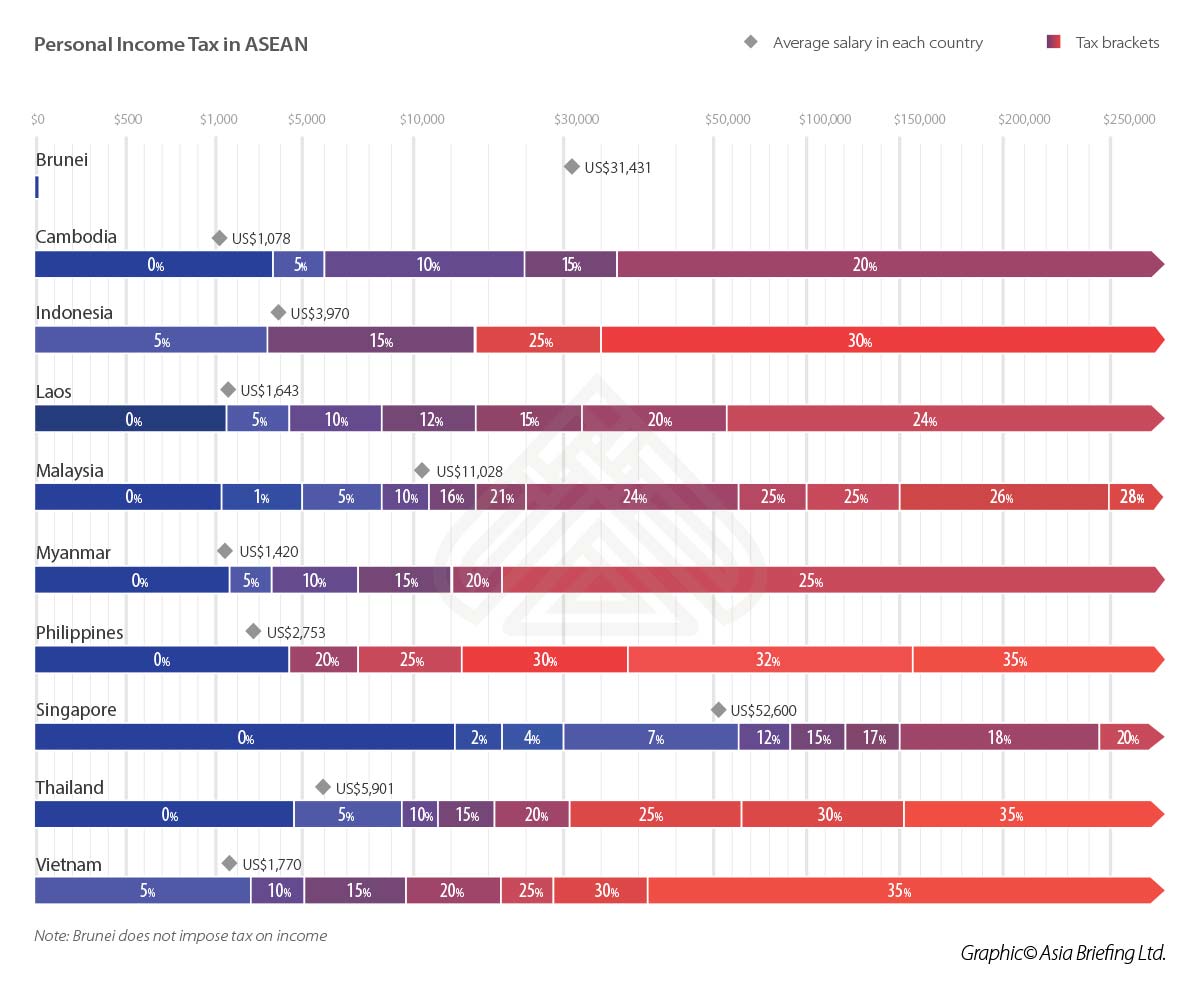

Malaysia corporate tax rate 2018 table. Resident individuals chargeable income rm ya 2018 2019 tax rm on excess 5 000 0 1 20 000 150 3 35 000 600 8 50 000 1 800 14 70 000 4 600 21 100 000 10 900 24 250 000 46 900 24 5 400 000 83 650 25 600 000 133 650 26 1 000 000 237 650 28 a qualified person defined who is a. The standard corporate tax rate of 24 for a period of five years with a possible extension for another five years. 6 2 taxable income and rates 6 3 inheritance and gift tax 6 4 net wealth tax.

Corporate tax rate in malaysia averaged 26 21 percent from 1997 until 2020 reaching an all time high of 30 percent in 1997 and a record low of 24 percent in 2015. Masuzi march 12 2019 uncategorized no comments. On the first 5 000 next 15 000. Calculations rm rate tax rm 0 5 000.

The government has also included a new condition whereby this concessionary income tax rate of 17 will only give to a company having gross business income from one or more sources for the relevant year of assessment of not more than rm50 million in addition to the ordinary share capital requirement. 2018 2019 malaysian tax booklet 22 rates of tax 1. Companies incorporated in malaysia with paid up capital of myr 2 5 million or less and that are not part of a group containing a company exceeding this capitalization threshold is 18 on the first myr 500 000 with the balance being taxed at the 24 rate. The current cit rates are provided in the following table.

For both resident and non resident companies corporate income tax cit is imposed on income accruing in or derived from malaysia. Corporate tax rates 2014 2018 updated february 2018 jurisdiction 2014 2015 2016 2017 2018 albania 15 15 15 15 15 algeria 25 23 26 26 26. Malaysia taxation and investment 2018 updated april 2018. Melayu malay 简体中文 chinese simplified malaysia corporate income tax rate.

Chargeable income myr cit rate for year of assessment 2019 2020.