Mot Calculator Malaysia 2017

On 10 april 2017 the income tax exemption no.

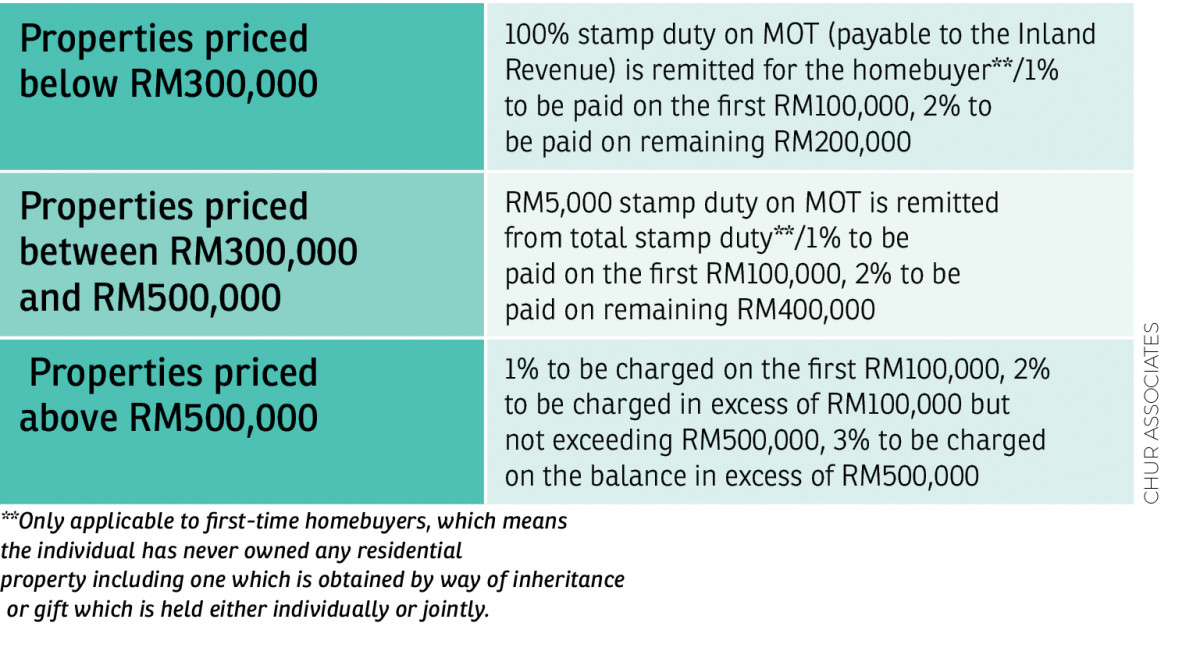

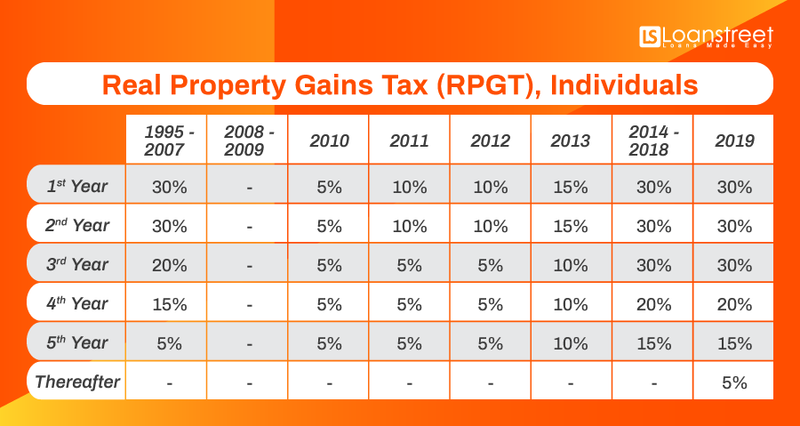

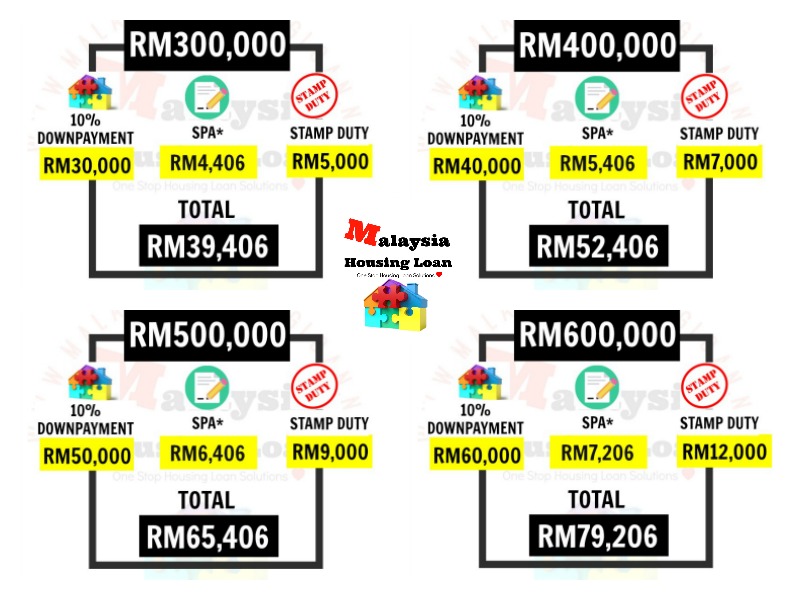

Mot calculator malaysia 2017. We accept no liability for loss or damage suffered or incurred by you or your estate as a result of your reliance on the material above or. On other hand stamp duty which also known as memorandum of transfer mot is payable to the government collected by lawyer on behalf of the government. Find out this spa stamp duty calculator here. Transport minister datuk seri dr wee ka siong held a discussion with the two top officials of the maritime institute of malaysia mima on the direction of the policy research body that focuses on malaysia s interest at sea.

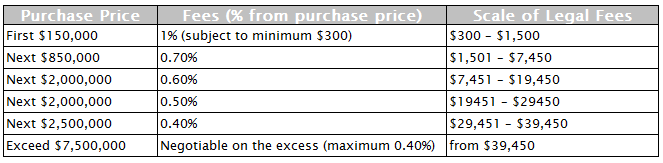

Please enter the dimensions in the white fields below. If maket value who determine the price. Hi brought my 1st house yr 2003 and developer wound up. For property price exceeding rm7 5 million legal fees of the excess rm7 5 million is negotiable but subjected to maximum of 0 5.

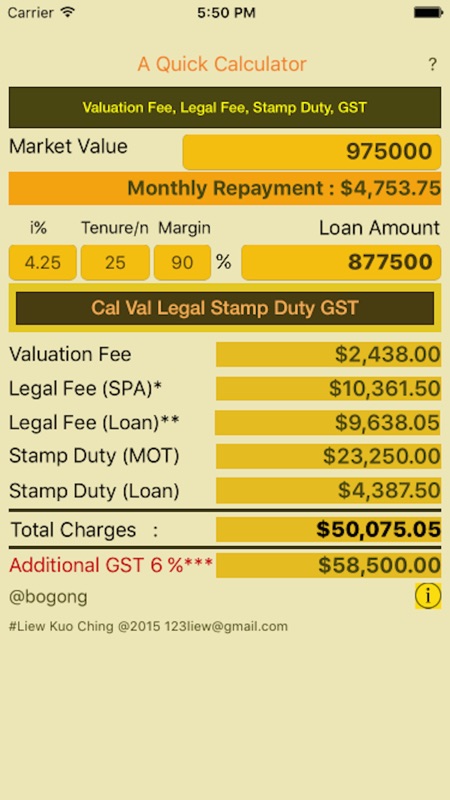

Contact us today. To use the calculator key in the property price. The calculator will automatically calculate total legal or lawyer fees and stamp duty or memorandum of transfer mot. Generate housing loan tables and charts and save as pdf file.

So if you guys have any questions just call us at 6012 6946746. Such qualifying persons are required to have been carrying on a business for more than two years and earned chargeable. Do i eligble for rebate disbursement as a new house owner. We open for online consultation as usual.

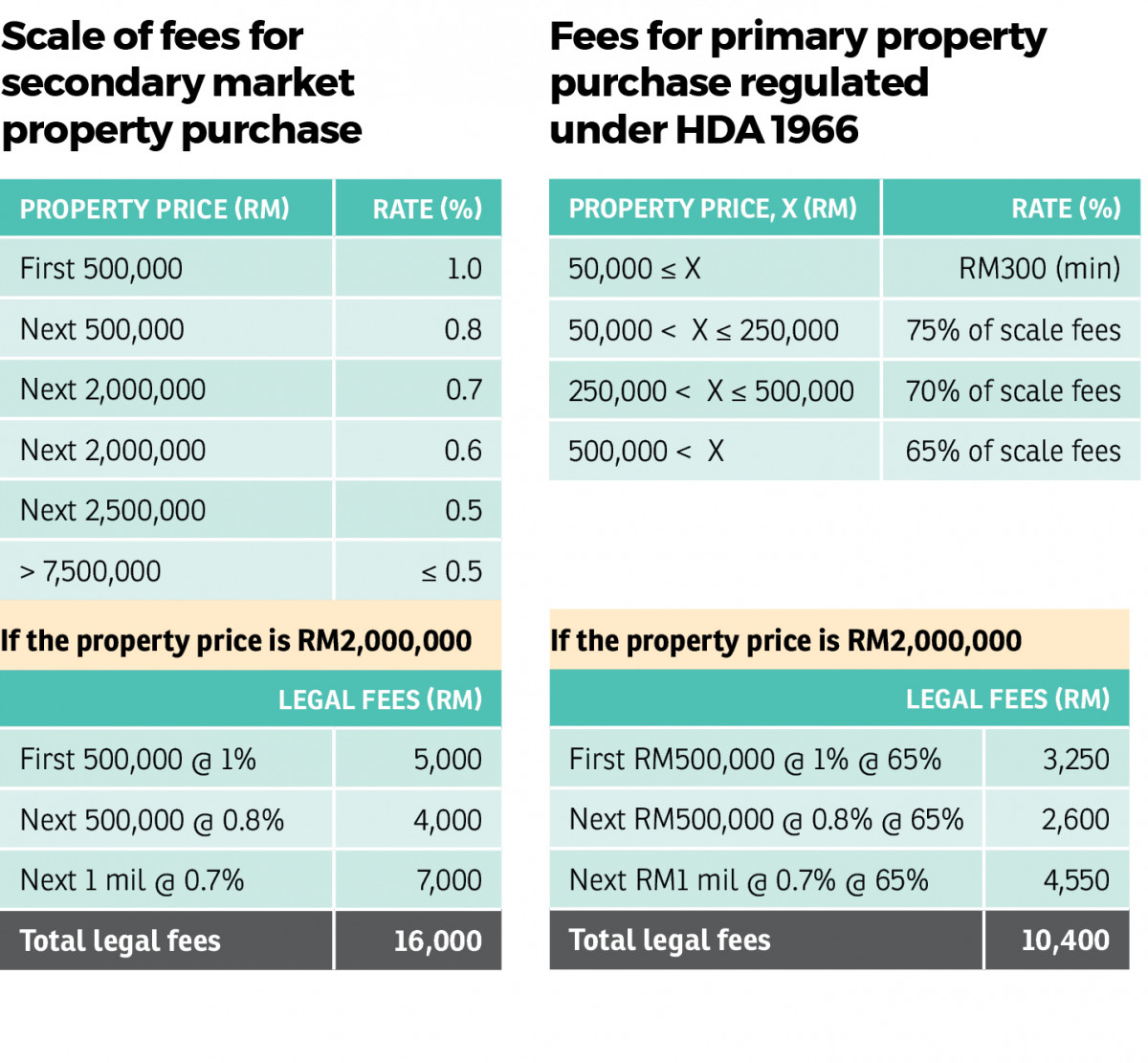

We have made every effort to ensure the accuracy and correctness of the calculations contents information or data contained in this section. However we do not represent or warrant the truth accuracy completeness and correctness of the same. Legal or lawyer fees. So stamp duty of mot 2018 will be based on spa price or market valau price.

Malaysia home loan calculator to estimate your monthly house loan repayments. You can calculate how much spa stamp duty you need to pay for your house. 2 order 2017 was gazetted to provide a special income tax exemption for companies limited liability partnerships trust bodies executors of estates and receivers under subsection 68 4 of the income tax act 1967 the act.