Mutual Fund Vs Unit Trust Vs Etf

The unit trust can also be termed as a mutual fund.

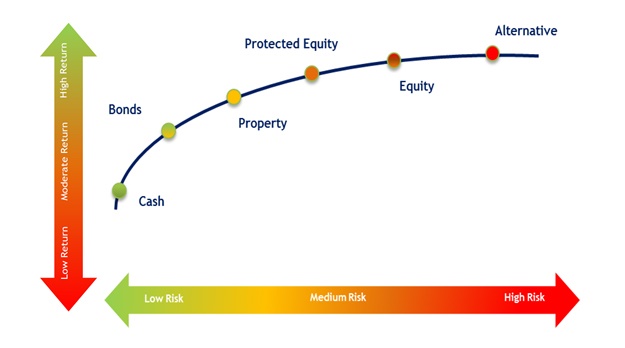

Mutual fund vs unit trust vs etf. What exactly are mutual funds or units trust. With a unit trust individual investors pool their money into a unit trust and then the fund manager oversees the fund by investing in individual securities such as stocks or bonds. Here s how you can choose the funds that are right for you. Mutual funds seem to be the clear leader in the open ended fund world with more than 16 trillion in net assets as of 2016.

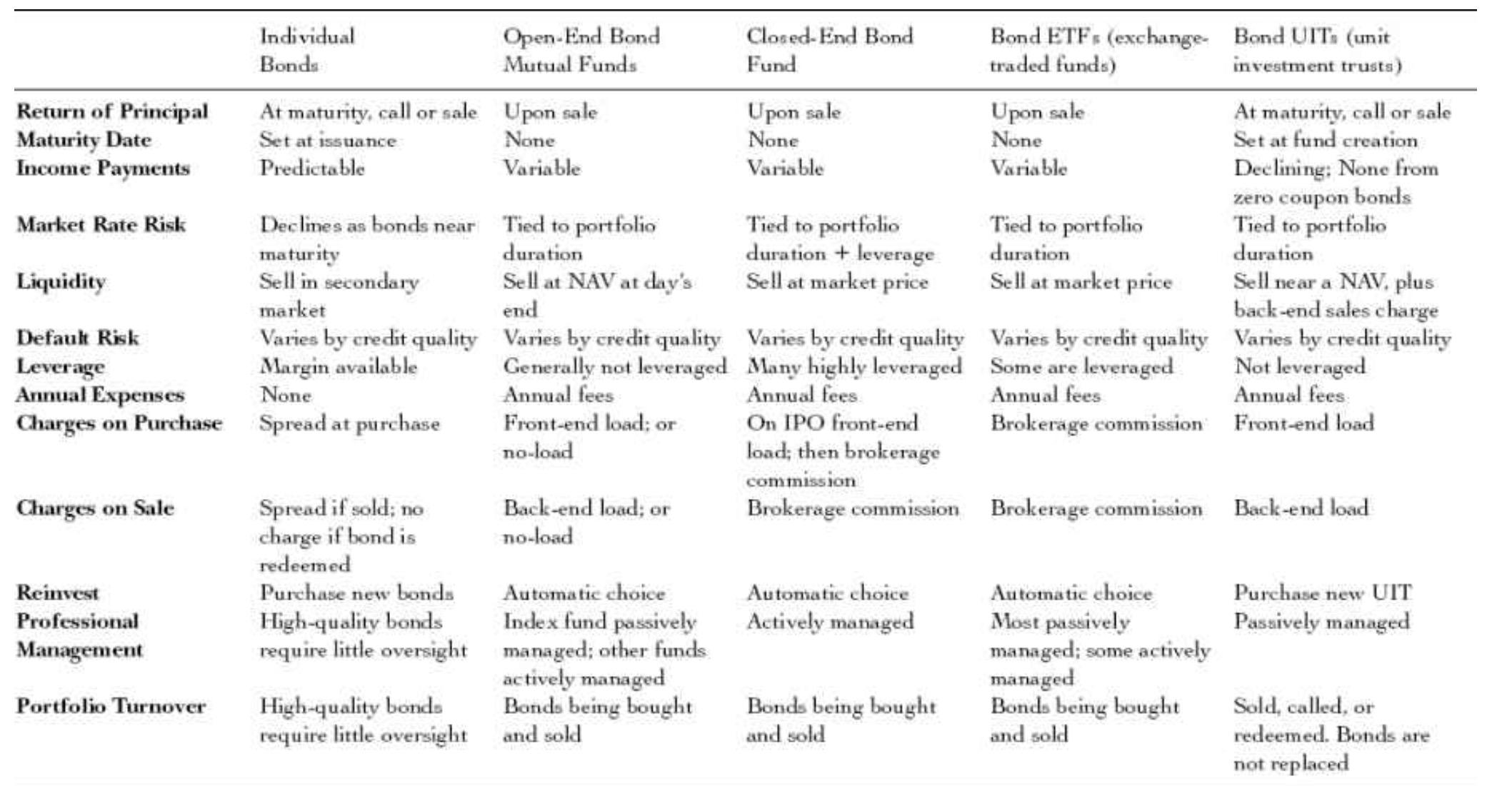

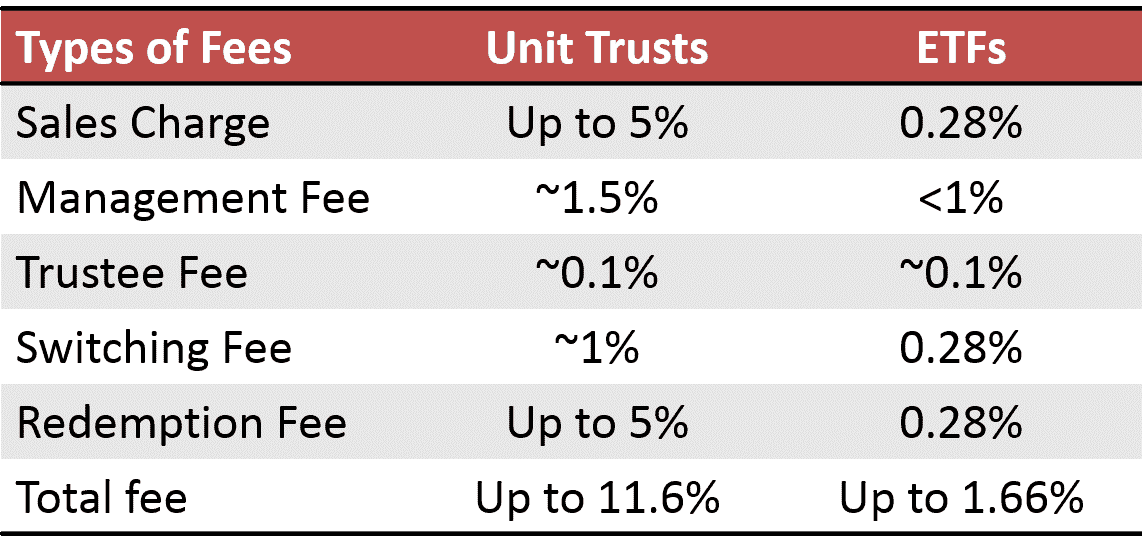

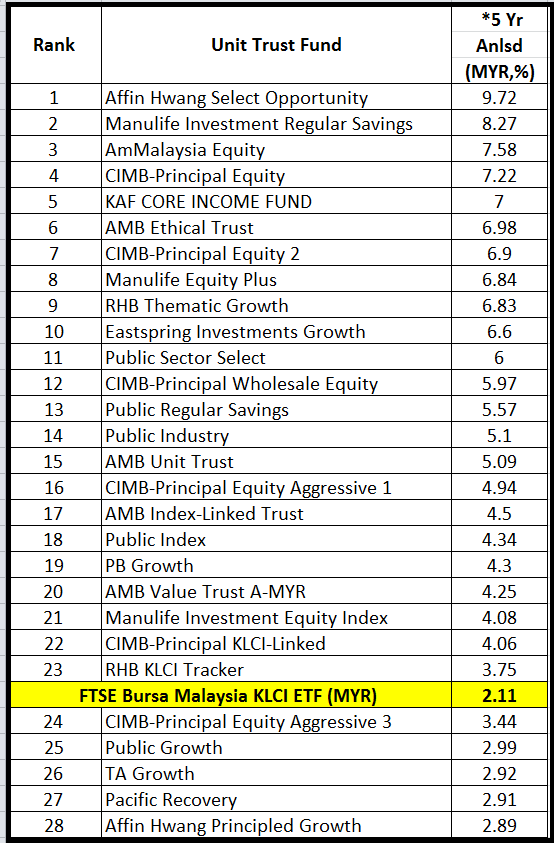

Since unit trusts require the expertise of the fund managers they typically offer higher costs than etfs. When investing in etfs you will have exposure to the volatility of the benchmark that the etf is. Mutual funds and unit investment trusts are both investment vehicles that allow investors to own a pool of different stocks bonds or other asset classes in one single unit. With a unit trust individual investors pool their money into a unit trust and then the fund manager oversees the fund by investing in individual securities such as stocks or bonds.

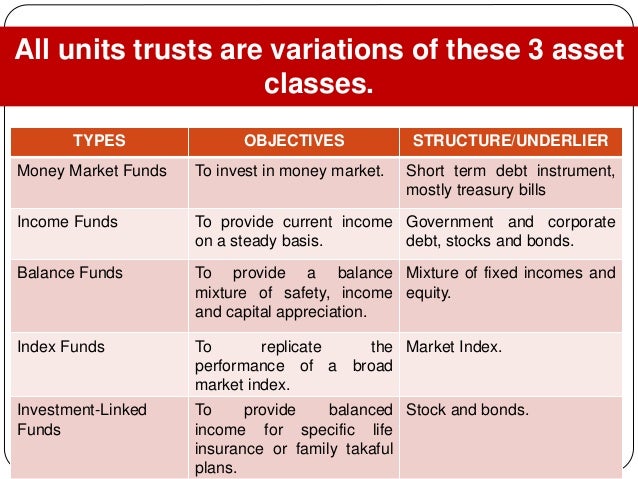

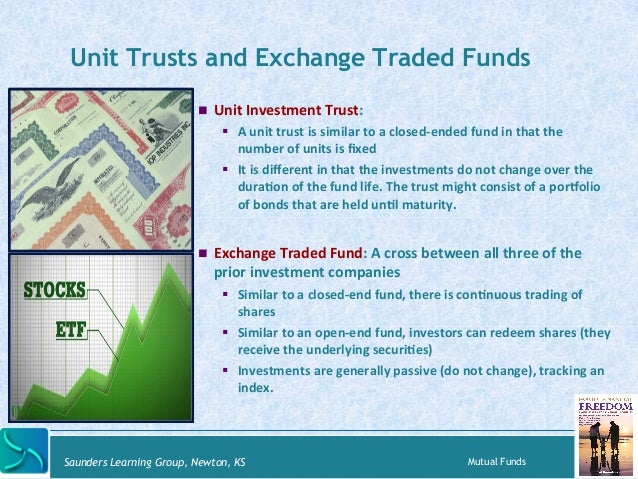

Exchange traded funds etfs might share some similarities with unit investment trusts uits including transparency and tax efficiency there are some key differences for investors to understand. How to decide between choosing etfs vs mutual funds or unit trusts there are hundreds of etfs and mutual funds in the market but they re not all the same. However let s take a look at the real numbers behind mutual funds and unit trusts. A unit trust fund pools money from investors to meet a specific financial objective.

The manager of the fund then takes the money and invest it in various shares or bond. A unit trust or mutual fund is an actively managed investment tool. Investing in a mutual fund is like purchasing a slice of a big cake. A mutual fund is similar to a unit trust however differing factor is the legal structure.

Like an etf it has many securities beneath it but the two differ in how the funds are created. Both types of funds consist of a mix of many different assets and represent a common way for. Funds are continuously offered with changing portfolios while uits are one time purchases with static portfolios. A unit trust or mutual fund is an actively managed investment tool.

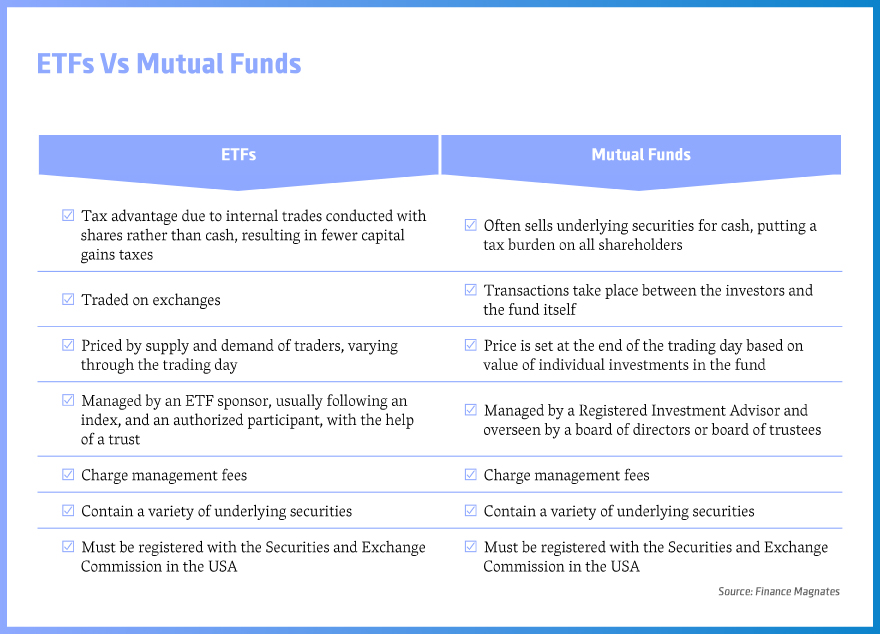

Investors own shares in the case of mutual funds or units in the case of uits. Both mutual funds and unit investment trusts pool money from investors and purchase securities. Mutual funds and exchange traded funds etfs have a lot in common.

:max_bytes(150000):strip_icc()/GettyImages-1036559046-8854b585e5fd417e9c189c51a2f7ca23.jpg)

:max_bytes(150000):strip_icc()/MutualFund2-0ca2ba12fdc4424cb0e4155bf9ef3c25.png)