Personal Tax Rate 2017 Malaysia

The personal income tax rates for 2018 2019 have been restructured and are different from previous year s rates.

Personal tax rate 2017 malaysia. Being taxed at the 24 rate. In malaysia for at least 182 days in a calendar year. Green technology educational services. 1 pay income tax via fpx services.

No guide to income tax will be complete without a list of tax reliefs. This page is also available in. The reduction in the tax rate will apply to the portion of chargeable income representing the increase. Technical or management service fees are only liable to tax if the services are rendered in malaysia while the 28 tax rate for non residents is a 3 increase from the previous year s 25.

For expatriates that qualify for tax residency malaysia has a progressive personal income tax system in which the tax rate increases as an individual s income increases starting at 0 percent and capped at 30 percent. Here are the many ways you can pay for your personal income tax in malaysia. First of all you need an internet banking account with the fpx participating bank. To make the payment please go to byrhasil at https.

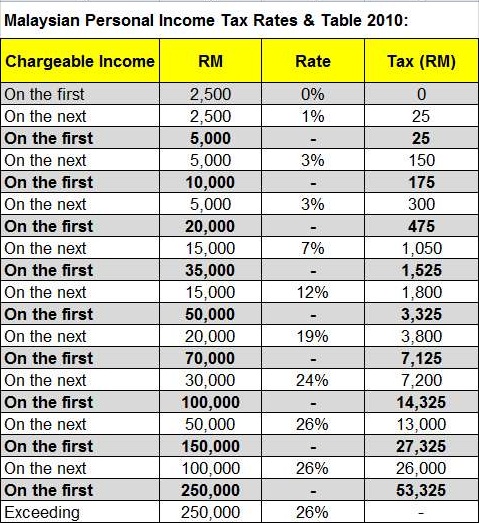

Income tax rate malaysia 2018 vs 2017 for assessment year 2018 the irb has made some significant changes in the tax rates for the lower income groups. Tax rates in malaysia. Income tax rates 2020 malaysia. Malaysia s prime minister najib razak presents the government s 2017 budget on.

There will likely be no cut to personal income tax rates. Below are the individual personal income tax rates for the year of assessment 2019 provided by the the inland revenue board irb lembaga hasil dalam negeri lhdn malaysia. Melayu malay 简体中文 chinese simplified malaysia personal income tax rate. For ya 2017 and ya 2018 and 4 on the standard tax rate for a portion of their income if there is an increase of 5 or more in the company s chargeable income compared to the immediately preceding ya.

2017 at 1 12 am nice information about the tax system. Some items in bold for the above table deserve special mention. Pwc 2016 2017 malaysian tax booklet personal income tax tax residence status of individuals an individual is regarded as tax resident if he meets any of the following conditions i e. Not only are the rates 2 lower for those who has a chargeable income between rm20 000 and rm70 000 the maximum tax rate for each income tier is also lower.

A qualified knowledge worker in a specified area currently only iskandar malaysia is taxed at the concessionary rate of 15 on chargeable income from employment with a designated company engaged in a qualified activity e g.