Real Property Company Malaysia Tax

Real property gain tax rpgt details of the malaysia tax on disposal of property.

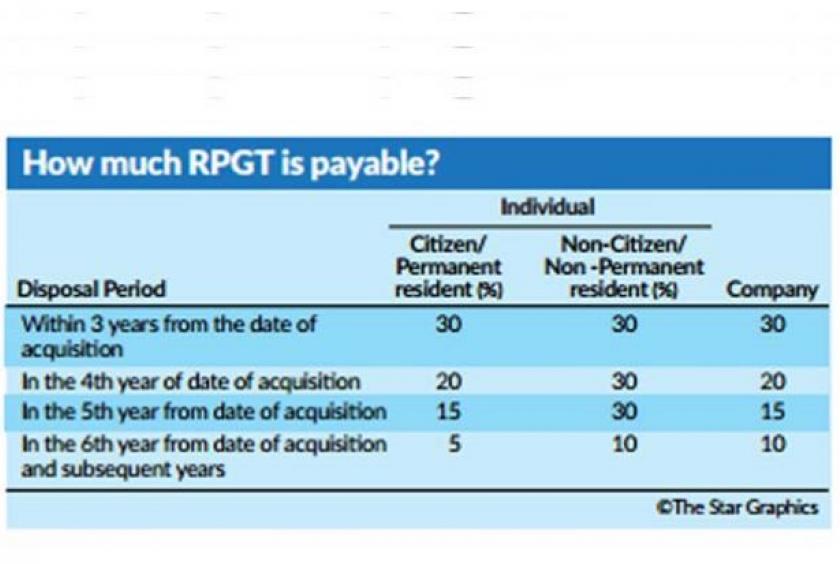

Real property company malaysia tax. Real property gains tax rpgt is a tax charged on gains arising from the disposal or sale of real property or shares in a real property company rpc. The exception being profit accruing from the sale of real property. As such rpgt is only applicable to a seller. Spa stamp duty memorandum of transfer aka mot loan agreement stamp duty cukai taksiran cukai tanah and real property gains tax.

Real property means any land situated in malaysia and any interest option or other right in or over such land. Real property gains tax rpgt is a form of capital gains tax that homeowners and businesses have to pay when disposing of their property in malaysia. Generally malaysia does not charge any capital gains tax neither does malaysia have a cgt regime on sale of shares. Under the real property gains tax act 1976 rpgt act an rpc is a controlled company which the defined value of its real property or shares in another rpc or both is at least 75 of the value of its tangible assets.

Real property is defined as any land situated in malaysia and any interest option or other right in or over such land. Real property gains tax rpgt in malaysia. Real property gains tax. Latest real property gains tax rpgt in malaysia 2020.

Real property gains tax rpgt is a tax chargeable on the profit gained from the disposal of a property and is payable to the inland revenue board. Which means that if one day you decide to sell your house you have to pay taxes on the profit gains if you have any. Following the previous post on real property gains tax rpgt this post aims to shed a spotlight on another field of transaction which will also attract rpgt sale of shares in a real property company rpc. Real property gain tax or in malay is cukai keuntungan harta tanah ckht is a tax imposed on gains derived from the disposal of properties in malaysia.

Malaysian local company non malaysian. There are 5 different property taxes in malaysia. Rpc is essentially a controlled company where its total tangible assets consists of 75 or more in real property and or shares in another rpc. It was suspended temporarily in 2008 2009 and reintroduced in 2010.

Property stamp duty memorandum of transfer the worst taxes are the ones you get slapped with before you even own a property.