Section 127 Income Tax Act Malaysia

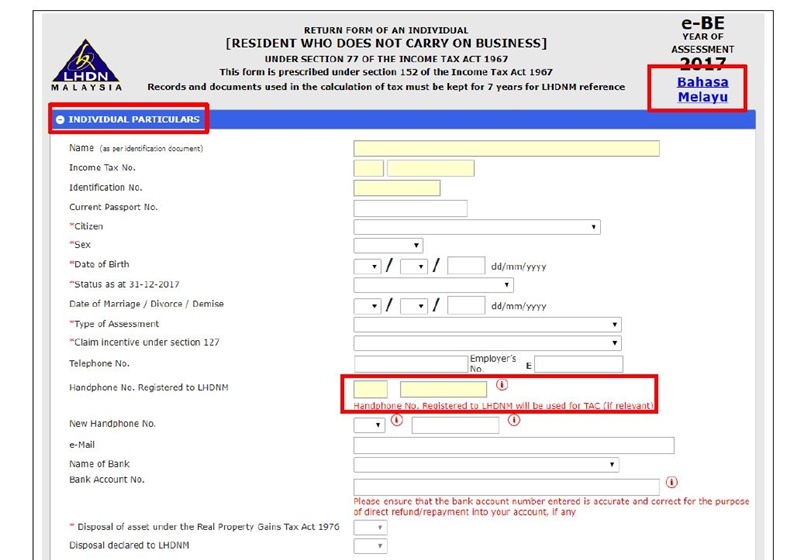

In the same page there is an item called entitled to claim incentive under section 127 which refers to claiming incentives under section 127 of the income tax act ita 1976.

Section 127 income tax act malaysia. Business income income arising from services rendered by an ohq company to its offices or related companies. Section 127 3 b for tier 1 and value added income incentives via a gazette order. Non chargeability to tax in respect of offshore business activity 3 c. It is only applicable to those who have incentives claimable as per government gazette or with a minister s approval letter.

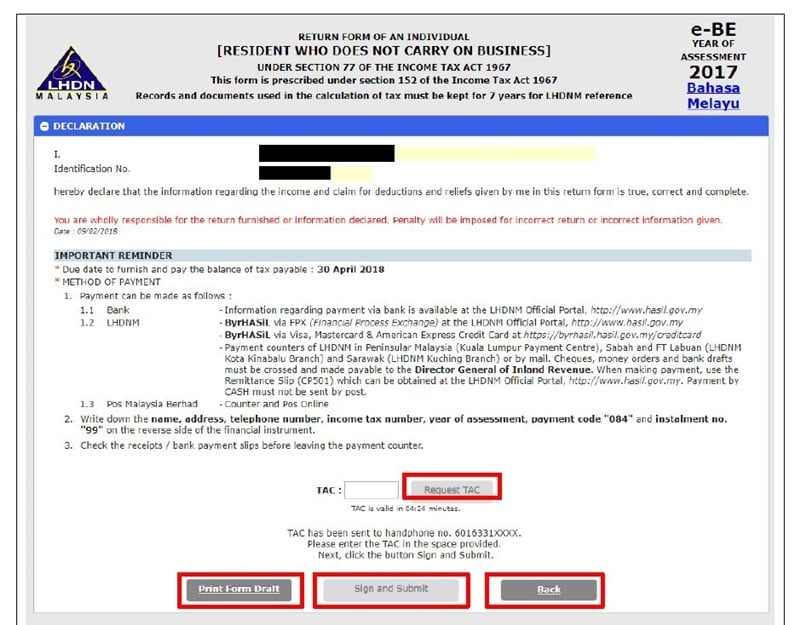

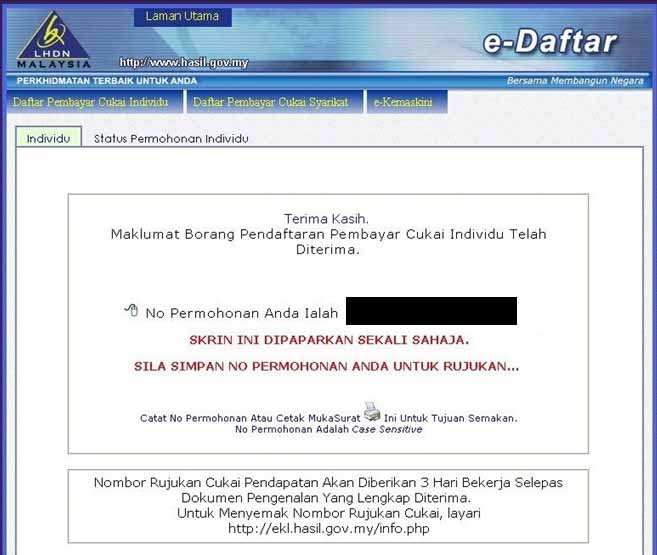

The income tax act 1967 malay. A tac which is needed to sign and submit your e form will be sent to your handphone number registered to lhdn so ensure it is correct. The income tax act 1967 in its current form 1 january 2006 consists of 10 parts containing 156 sections and 9 schedules including 77 amendments. Section 127 of the income tax act 1967 ita is included in the mutual exclusion list of a gazette order the taxpayer therefore cannot make a claim for the incentive offered in the said gazette order.

A tac which is needed to sign and submit your e form will be sent to your handphone number registered to lhdnm so ensure it is correct. It is only applicable to those who have incentives claimable as per government gazette or with a minister s approval letter. Incentive under section 127 refers to the income tax act 1976. There will also be a layak menuntut insentif dibawah seksyen 127 which refers to claiming incentives under section 127 of the income tax act ita 1976.

Interpretation part ii imposition and general characteristics of the tax 3. The revised guideline is available on mida s website www mida gov my resources forms and. This is incentives such as exemptions under the provision of paragraph 127 3 b or subsection 127 3a of ita 1976 which is claimable as per government gazette or with a minister s approval letter. The incentive under section 127 refers to the income tax act 1976 applicable only to those who have incentives claimable as per government gazette or with a minister s approval letter.

Following sections of the income tax act 1967. Akta cukai pendapatan 1967 is a malaysian laws which enacted for the imposition of income tax. An approved ohq company is eligible for income tax exemption for a period of 10 years under section 127 income tax act 1967 for income derived from the following sources. Short title and commencement 2.

Incentive under section 127 refers to the income tax act 1976. This is incentives such as exemptions under the provision of paragraph 127 3 b or subsection 127 3a of ita 1976 which is claimable as per government gazette or with a minister s approval letter. A tac this is required to sign and submit your e form.