Section 14 Application For Registration Of A Company Superform

Copy of certification of company business registration from ssm or section 15 notice of registration section 14 application for registration of a company section 17 certificate of incorporation of private company.

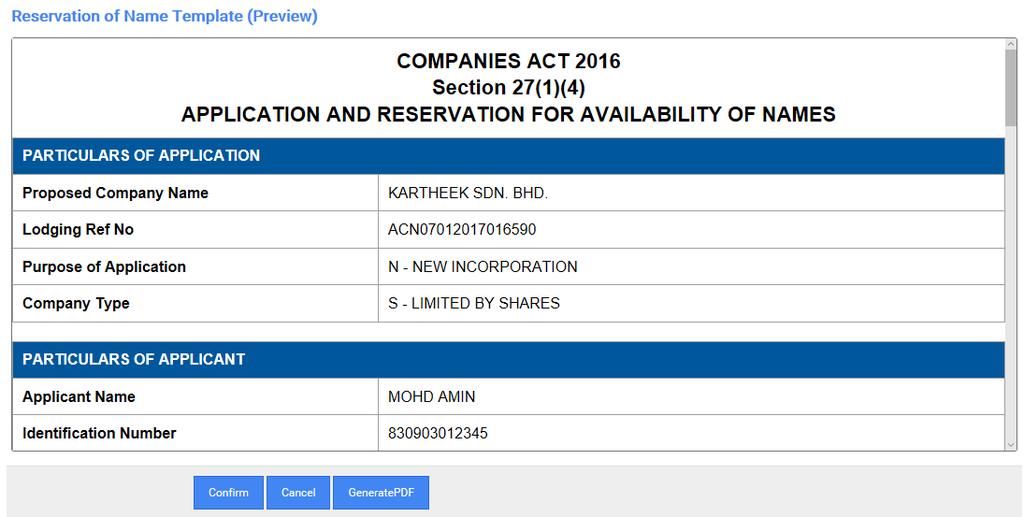

Section 14 application for registration of a company superform. The prescribed fees for registration of company limited by shares company limited by guarantee and unlimited company are rm1 000 00 rm3 000 00 and rm1 000 00 respectively and must be paid at the time of lodgment of the document. Section 105 form of transfer of securities all section 105 need to be read together with all form 32a form 44 notice of situation of registered office and of office hours and particulars of changes. Ii seksyen 14 section 14 superform application for registration of a company iii. Fill in the online registration form.

Rd 1 along with the fee as provided in the companies registration offices and fees rules 2014 and shall be accompanied by the. Effect of incorporation 1 upon the date of incorporation specified in the notice of registration issue under section 15 there shall be a company by the name and registration number as stated in the principal register kept by the registrar for this purpose. Section 14q deduction is given to a business that is carrying on a trade business or profession. Generally if your company falls under the manufacturing services or mining quarrying sector based on psmb act 2001 and your company employs a minimum of ten 10 malaysian employees it is compulsory for your company to register with human resource development fund hrdf.

Iv borang 13 form 13. Section 46 3 notification of change in the registered address only the. Notice of registration of company under section 15 companies act 2016 or certificate of incorporation of company under section 17 companies act 2016 if available notification of change in the register of directors managers and secretaries under section 58 companies act 2016. Upload sijil perakuan pemerbadanan syarikat and section 14 superform particulars of director officer.

Hence investment holding companies do not qualify for section 14q deduction as they do not carry on a trade or business for tax purposes but own investments such as properties and shares for long term investment and derive passive investment income such as rental dividend or interest. The registration of employers is stipulated in the pembangunan sumber manusia berhad act 2001 psmb act 2001. Section 14 application for registration of a company.