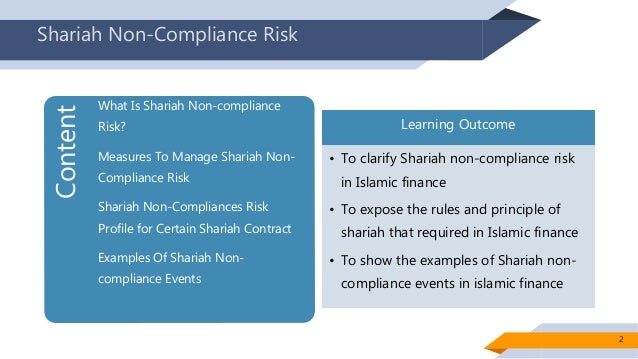

Shariah Non Compliance Risk

Islamic banks shall at all times comply with the shariah.

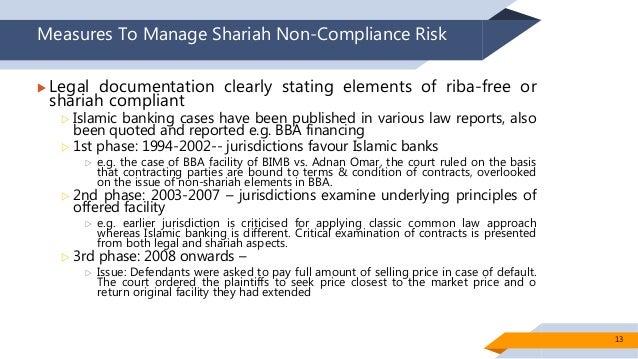

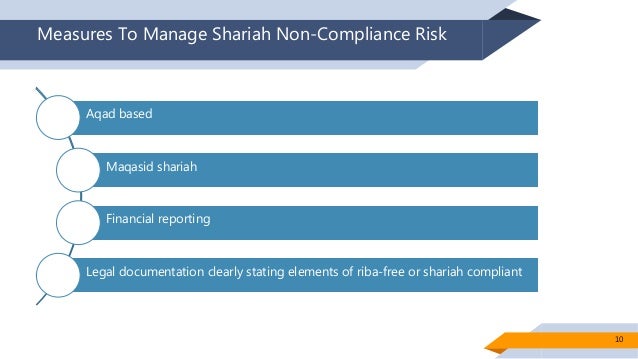

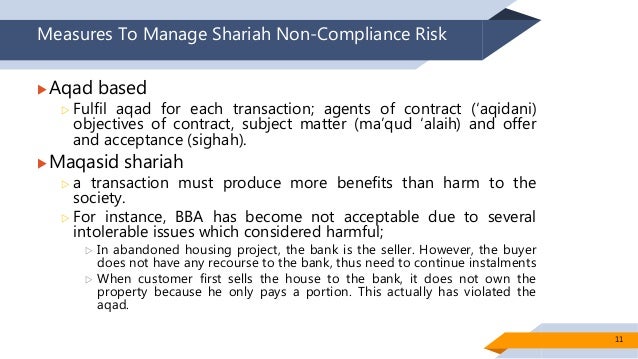

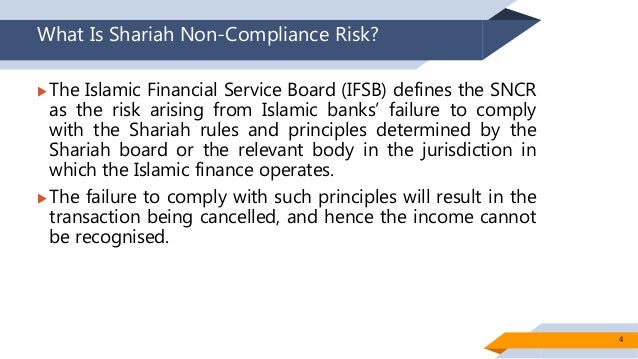

Shariah non compliance risk. Shariah risk ratings non comply totally contravene with shariah principles or the s s rulings or sa decisions or does not have shariah unit s sign off or approval. Impact on capital adequacy framework of islamic banks erdem oz ifsb zahid ur rehman khokher ifsb mohammad mahbubi ali isra dr. In addition the book offers helpful guidance and understanding for the legal departments of islamic financial institutions as well as lawyers legal firms shariah advisors shariah officers and students studying. The effective management of shariah non compliance risk is therefore paramount especially with the growing signifi cance of islamic fi nance as a key component of the fi nancial system domestically and globally.

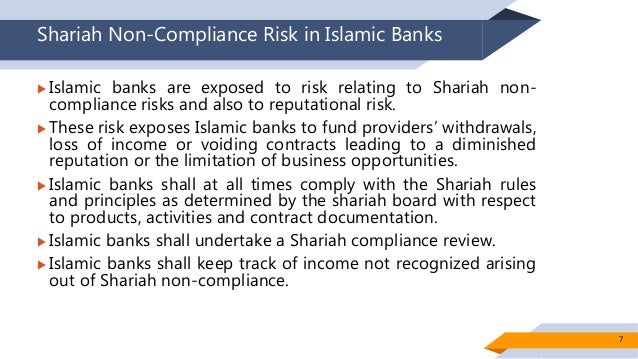

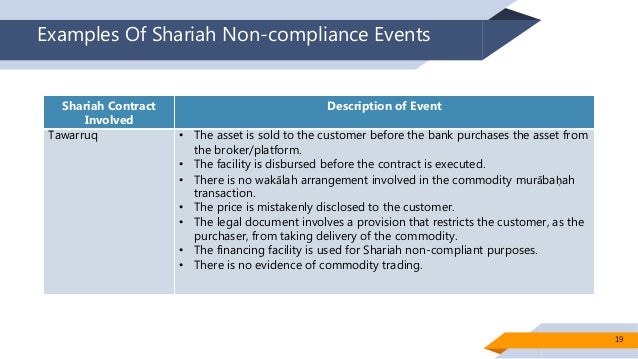

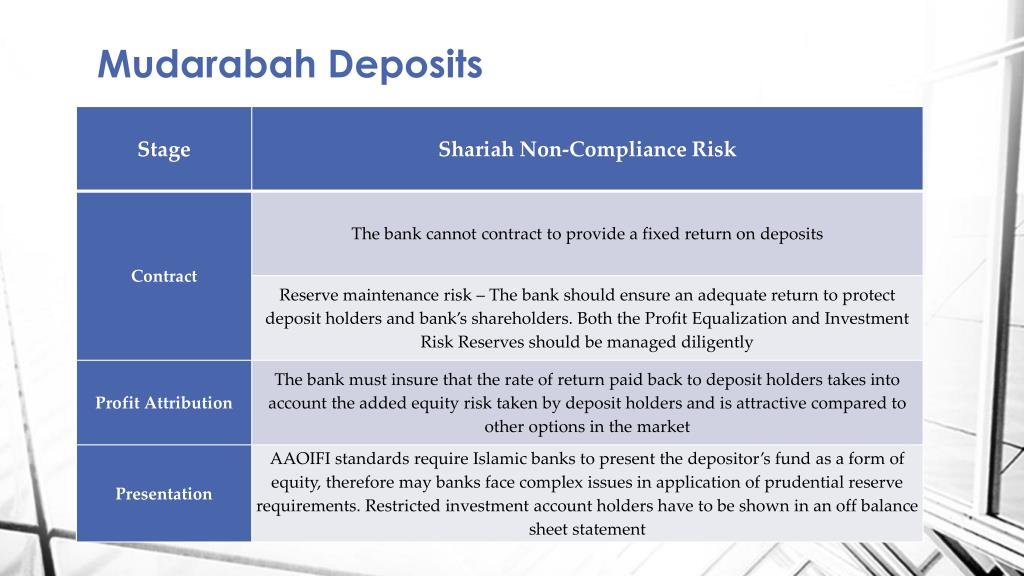

Shariah non compliance risk in islamic banks islamic banks are exposed to risk relating to shariah non compliance risks and also to reputational risk. The shariah compliance of a product is determined primarily by looking at the shariah compliant status of its underlying contract. Shariah non compliance risk has been defined as the risk that arises from the bank s failure to comply with the shariah rules and principles determined by the relevant shariah regulatory councils islamic financial services board ifsb by offering islamic banking. Shariah non compliance risk refers to the risk of legal or regulatory sanctions financial loss or non financial implications including reputational damage which an ifi may suffer arising from failure to comply with the rulings of the shariah advisory council of bank negara malaysia sac standards on.

These risk exposes islamic banks to fund providers withdrawals loss of income or voiding contracts leading to a diminished reputation or the limitation of business opportunities. This book offers a thorough look at non compliance risk and explains the legal documentation necessary to ensure compliance for professionals in the islamic finance industry. Shariah risks are a growing concern since the direct consequence of the non compliance with shariah is a decline in the profits as any profits related to a tainted and non shariah compliant transaction is haram forbidden and therefore the profits cannot be accounted as profits or distributed as dividends. Actual shariah non compliance risk restricted 11.

This working paper should not be reported as representing the views of the islamic financial services board ifsb. Once a product or transaction is flagged as potentially shariah non compliant in a shariah audit it is referred to the bank s shariah board to determine if the transaction is batil or fasid. This article highlights the approach by the bank and the practices of. Shariah compliant investment products and entities have an inherent shariah risk.

Romzie rosman isra march 2016 disclaimer.