Top 10 Unit Trust In Malaysia 2020

The best performer in the first half of 2020 is gold rated scottish mortgage trust with a gain of 41 98 and the worst is neutral rated temple bar with a fall of 46.

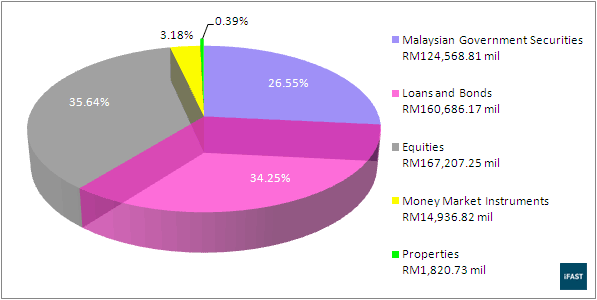

Top 10 unit trust in malaysia 2020. In terms of total fund size managed amongst private unit trust companies and prs providers in malaysia. Whether you are a seasoned investor or a beginner unit trusts may be the way to go. Learn more about the changes and how our new features help your investing success. High and very high vcs as at 31 august 2020 are 0 000 vf 3 625 3 625 vf 10 335 10 335 vf.

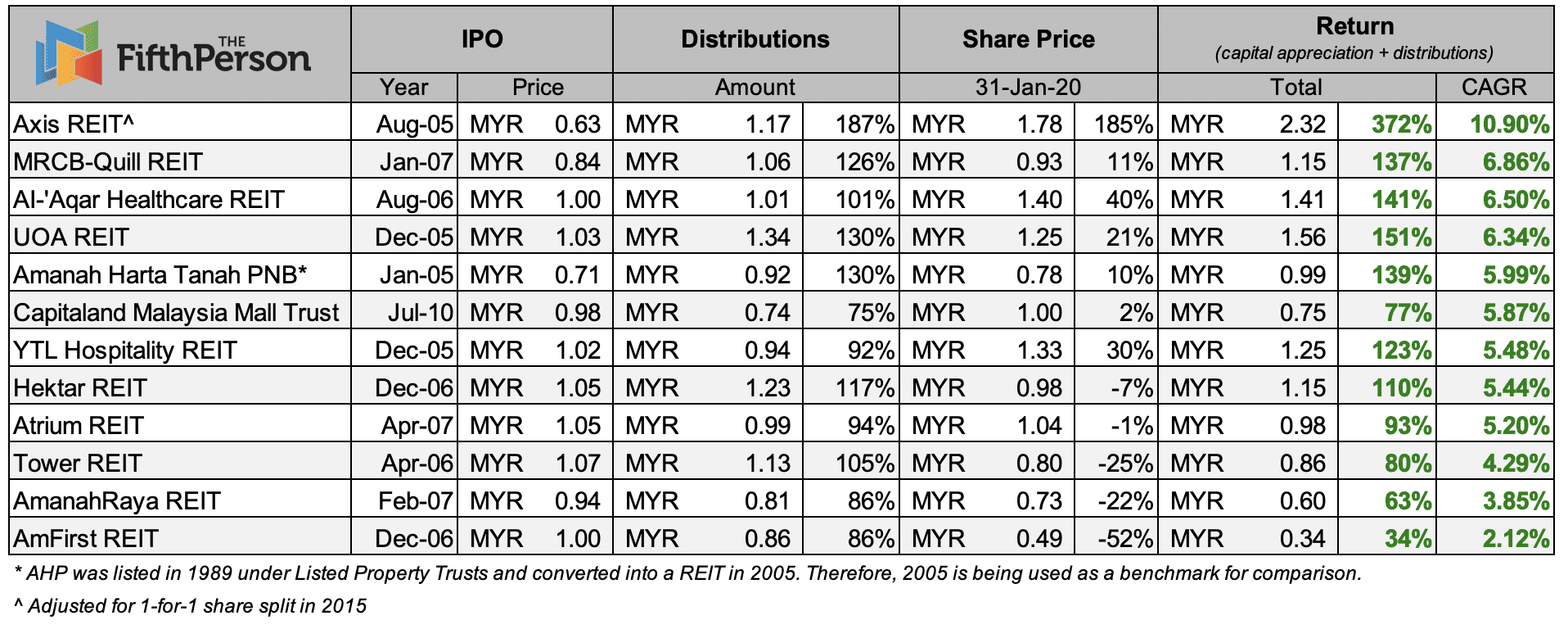

Asb is a premier unit trust investment specifically for malaysian bumiputeras. Out of the 20 s reits that have been listed for listed for at least 10 years 16 of them gave a positive overall return for investors. Trustnet finds out which funds and sectors have navigated one of the toughest quarters in recent memory. Shane my publish date.

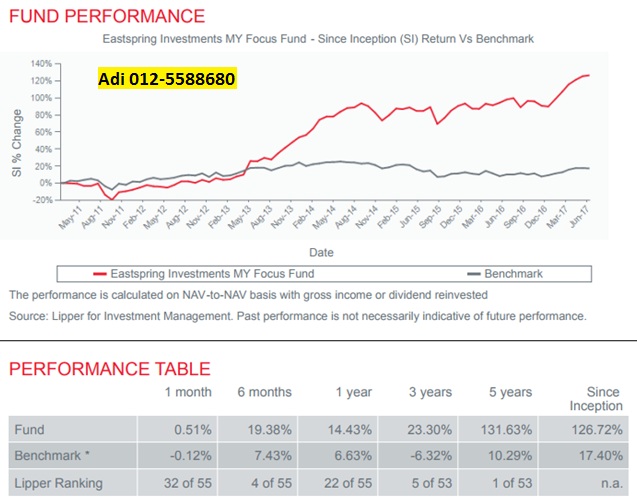

If you had invested rm1 000 at the beginning of 2009 it would have grown to rm2 329 by the end of 2019. Amanah saham bumiputera asb risk. Sat 4 jul 2015 12 38 pm. Find the best unit trust investment in malaysia.

Below depending on your objective you will find the best performing unit trust funds to invest and grow your money. In this article we will look at their counterparts from across the causeway and do a similar study on the performance of malaysian. A 33 1 gain in 3 years when annualised works out to a 10 gain per year. Use the guide below to find the best unit trust investments based on your risk appetite.

Previously i updated an article about the top 10 singapore reits that would have made you money if you invested from their ipos. Top 5 performing funds for short term investment 1 5 years if you re investing for short term gain typically within 3 months to 5 years you must make sure that the fund you re investing can give a higher return than fixed deposit rate which averages around 3. Investors are advised to hold their unit trust investments over the long term to allow time for their. It is managed by amanah saham nasional berhad asnb a wholly owned subsidiary of permodalan nasional berhad pnb.

All returns of 3 years and above have been annualised e g. Performances are calculated on a bid to bid basis in their respective currency terms as indicated above with dividends being reinvested.