Unit Trust Vs Mutual Fund Malaysia

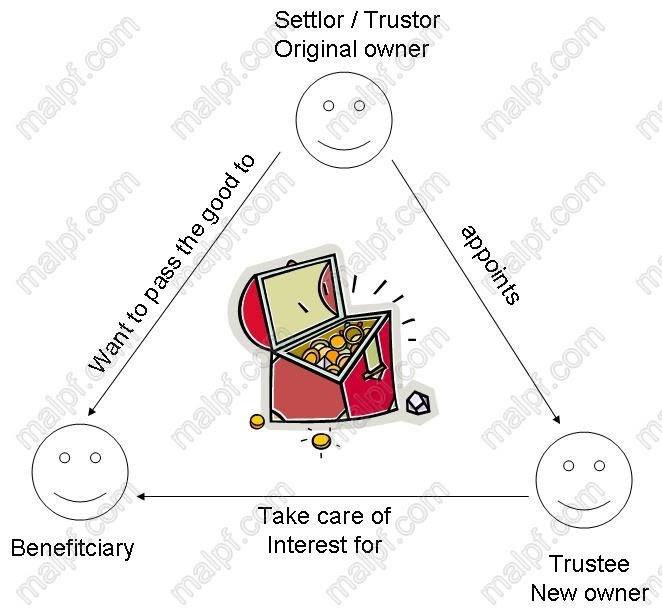

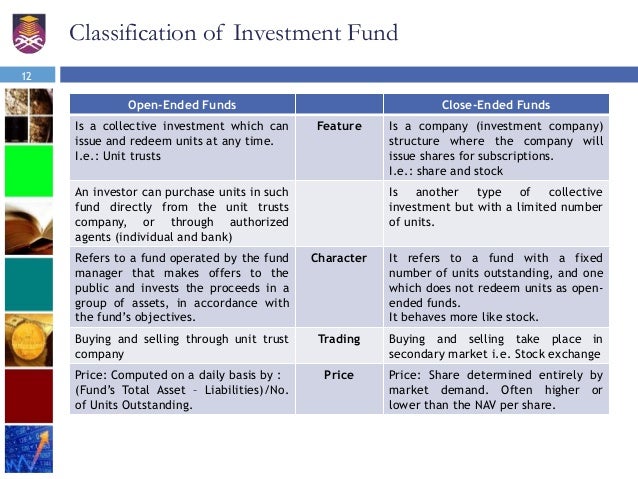

A unit trust is a fund which adopts a trust structure.

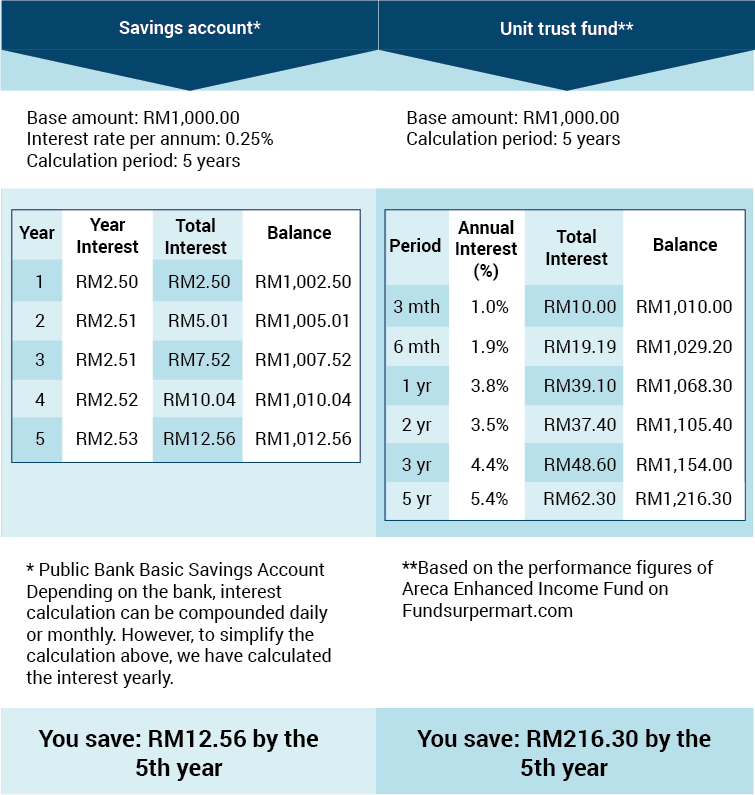

Unit trust vs mutual fund malaysia. Top 5 performing funds for short term investment 1 5 years if you re investing for short term gain typically within 3 months to 5 years you must make sure that the fund you re investing can give a higher return than fixed deposit rate which averages around 3. The term unit trust is often used in the british commonwealth while mutual fund is more widely used in the united states. Below depending on your objective you will find the best performing unit trust funds to invest and grow your money. If you sell your units in a unit trust fund and then purchase units in another fund you may have to pay a sales charge.

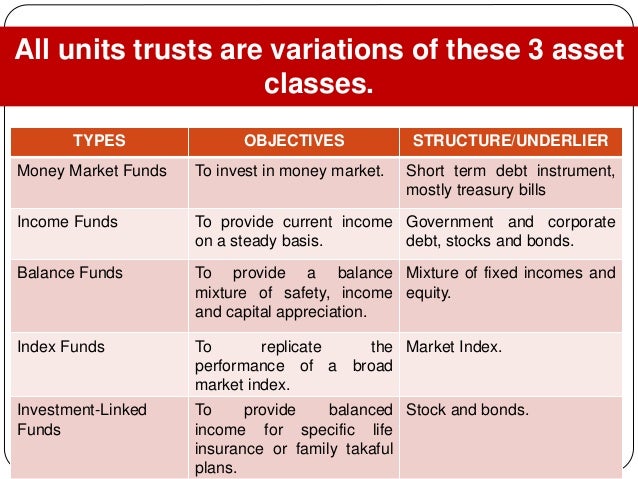

Nav refers to the fund s asset market value of all the assets under the unit trust minus the liabilities. Conversely a healthy fund will have a growing nav as the value also will determine your profit also known as capital appreciation because this will be the going price for your assets. A unit trust is a scheme in which people with similar investment objectives can pool their funds together for investment in different securities managed by professional fund managers to whom the fund is entrusted. We offer a comprehensive range of products comprising conventional and shariah based unit trust and prs funds as well as financial planning services.

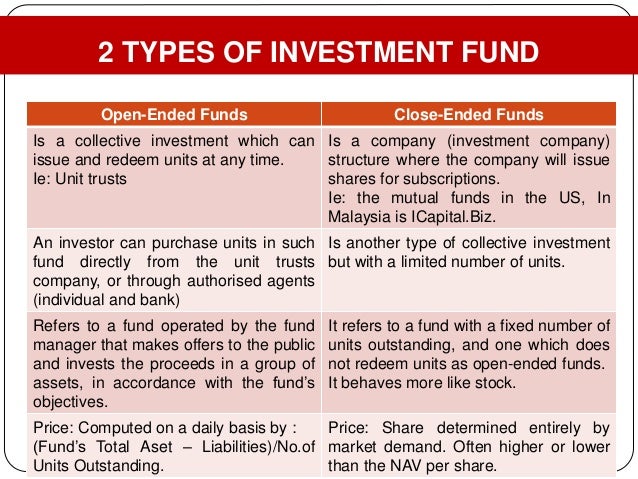

However if you switch from one fund to another fund that is managed by the same utmc you may not have to pay any sales charge. Practically both the terms mutual fund and unit trust can be used interchangeably in malaysia but there could actually be slight differences between the 2. In this guide the term fund will also refer to a unit trust. Unit trusts versus ilps investment linked insurance policies ilps are another way to invest in funds.

Mutual funds and unit investment trusts are both investment vehicles that allow investors to own a pool of different stocks bonds or other asset classes in one single unit. It is designed for long term investment because it capitalizes on using the power of compounding interest and hence is not advisable for people seeking short term gains. Public mutual berhad a wholly owned subsidiary of public bank is a top private unit trust management company and leading prs provider in malaysia. Not all funds use a trust structure.

Mutual fund is more a usa term while unit trust is a uk term. All unit trust investments will incur a sales charge.