What Is Ace Market And Leap Market

Bursa saw the first listing on the leap market in october 2017.

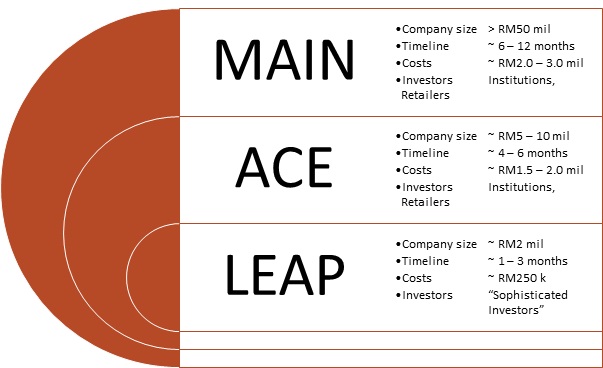

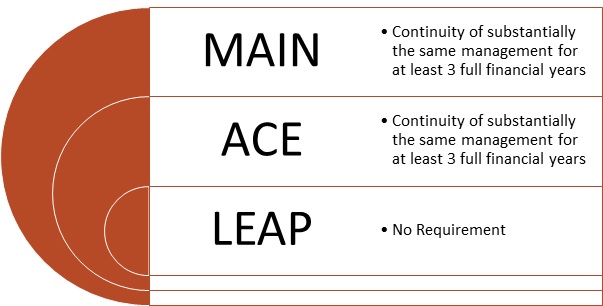

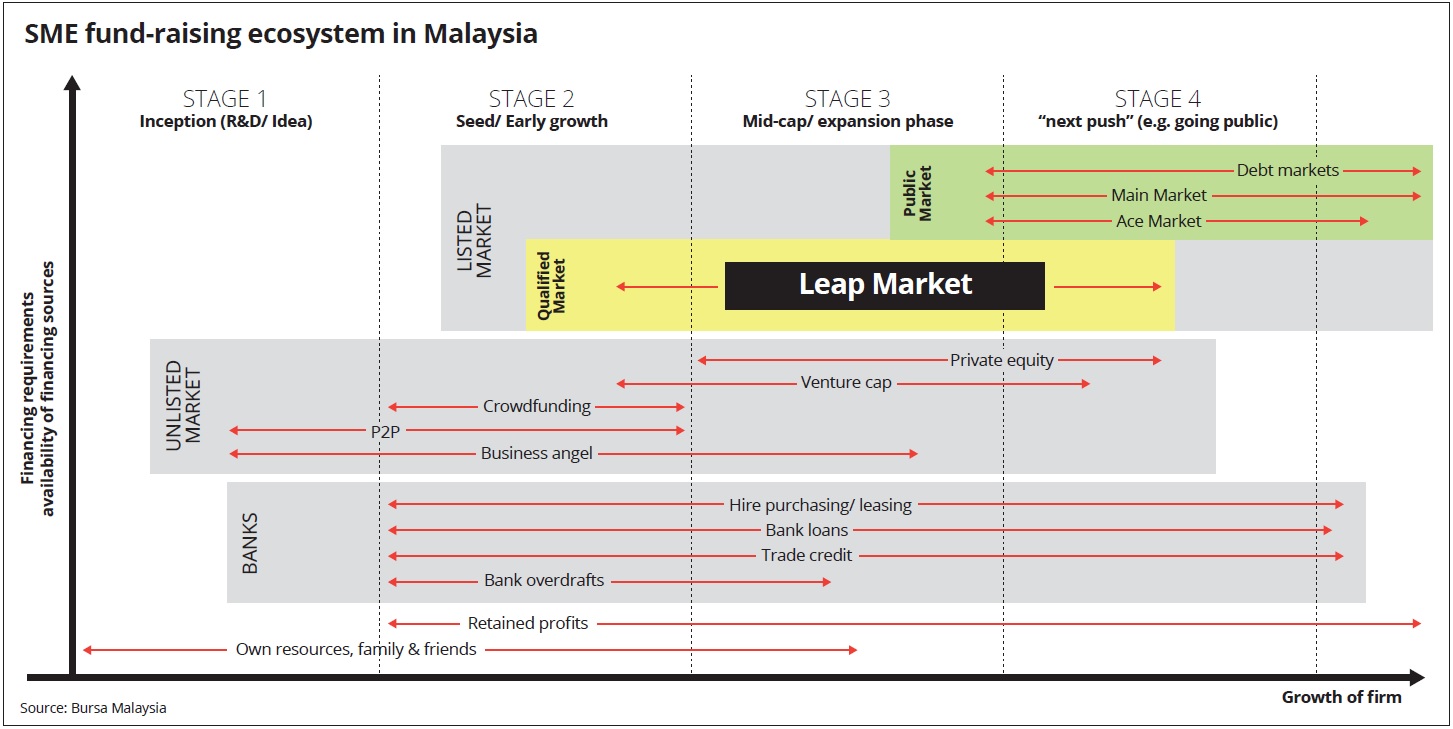

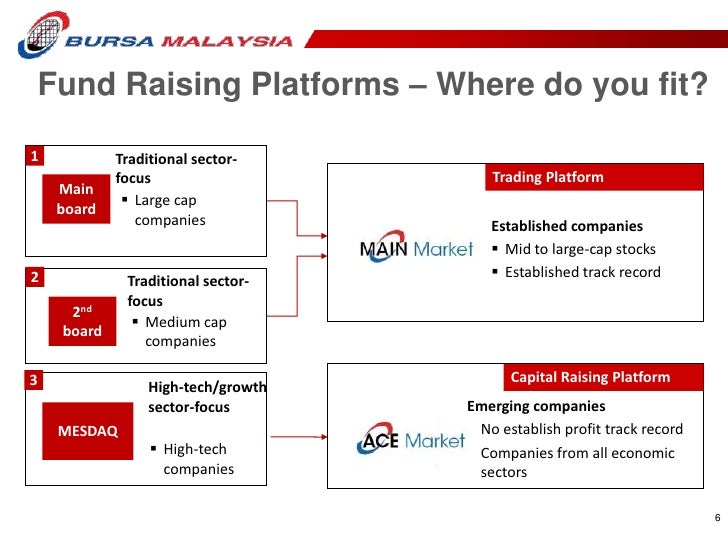

What is ace market and leap market. As for the third and latest market the leap market is a new platform intended for smes. The creation of the leap market was only intended for smes and would not help industry specific companies that did not qualify for the ace market. In fact the largest funds in malaysia have indicated wariness or even reluctance to add leap market companies in their portfolio. The leap market is designed to be an intermediary market for companies that complements the ace or main markets providing cost efficiency balanced and proportionate regulation and a qualified market for sophisticated investors.

This is where the market is specifically designed for the smaller players that want. The leap market is only open to sophisticated investors meaning that there is a smaller pool of investors compared to the ace and main markets. Ace market access programme is a three weeks structured programme to plug technology startups into the singapore regional startup ecosystems and help them internationalise through assessing the startup business target market connecting with relevant organisations investors and embarking on your expansion journey. While technology companies still dominate the ace market there are other new players as well.

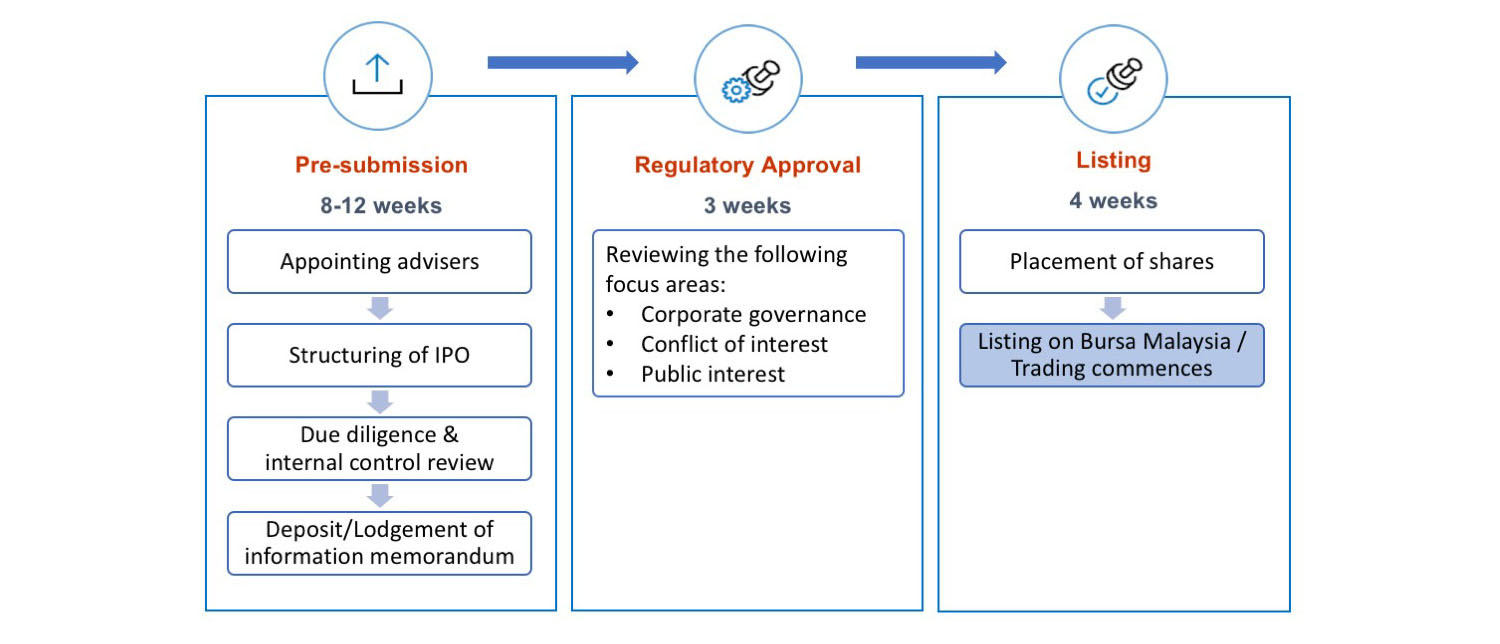

It adds that the leap market framework had been conceptualised based on a lower cost of listing and speedier time to market through appropriate regulatory requirements formulated on the basis that participation is limited to sophisticated investors. It made malaysia the first asean country to have an alternative capital raising platform for underserved small and medium enterprises smes. The leap market is a platform for small and medium enterprises smes to raise funds and visibility in the capital market despite not being able to meet the criteria for listing on the main market and the ace market in an efficient regulated and transparent marketplace. In fact some loss making companies or those with low profitability could be approved to be listed in the ace market if it is an innovative business in the r d or it industry.

This includes companies like iris corp bhd matang bhd xox bhd and many more.