Corporate Tax Rate Malaysia

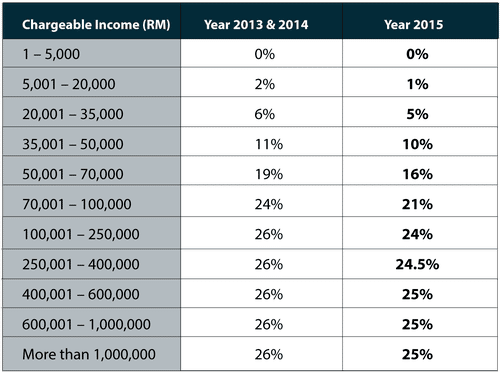

The current cit rates are provided in the following table.

Corporate tax rate malaysia. Income derived from sources outside malaysia and remitted by a resident company is exempted from tax. Only services rendered in malaysia are liable to tax. The corporate tax rate in malaysia stands at 24 percent. This page displays a table with actual values consensus figures forecasts statistics and historical data charts for list of countries by corporate tax rate.

However from 17 january 2017 to 5 september 2017 services rendered in and outside malaysia are liable to tax. Wht dividends 1. This tax is imposed on income that is derived from or accruing in the country both in the case of resident and non resident legal entities. The malaysia corporate tax rate has a standard rate as well as a smaller one applicable under certain conditions to small and medium resident companies.

This page provides malaysia corporate tax rate actual values historical data forecast chart statistics economic calendar and news. Chargeable income myr cit rate for year of assessment 2019 2020. Malaysia corporate withholding taxes last reviewed 01 july 2020. Although tax rates may vary based on yearly budget announcements corporate income tax must be submitted and filed on a yearly basis similar to an individual s personal income tax.

A company whether resident or not is assessable on income accrued in or derived from malaysia. A corporate tax rate of 17 to 24 is imposed upon resident and non resident companies on taxable income that is sourced from or obtained in malaysia. List of countries by corporate tax rate provides a table with the latest tax rate figures for several countries including actual values forecasts statistics and historical data. However please confirm tax rates with the country s tax authority before using them to make business decisions.

Tax rates are checked regularly by kpmg member firms. Kpmg s corporate tax table provides a view of corporate tax rates around the world. Where the recipient is resident in a country which has a double tax treaty with malaysia the tax rates for the specific sources of income may be reduced. Use our interactive tax rates tool to compare tax rates by country jurisdiction or region.

For both resident and non resident companies corporate income tax cit is imposed on income accruing in or derived from malaysia. Malaysia corporate income tax rate. The corporate tax in malaysia is one of the basic income taxes that are applicable to companies and to other entities that obtain an income from the sale of services or goods. Corporations making payments of the following types of income are required to withhold tax at the rates shown in the table below.

It represents a compulsory tax that is charged based on the income obtained in a financial year by a taxable entity this is why the malaysia corporate tax rate varies.