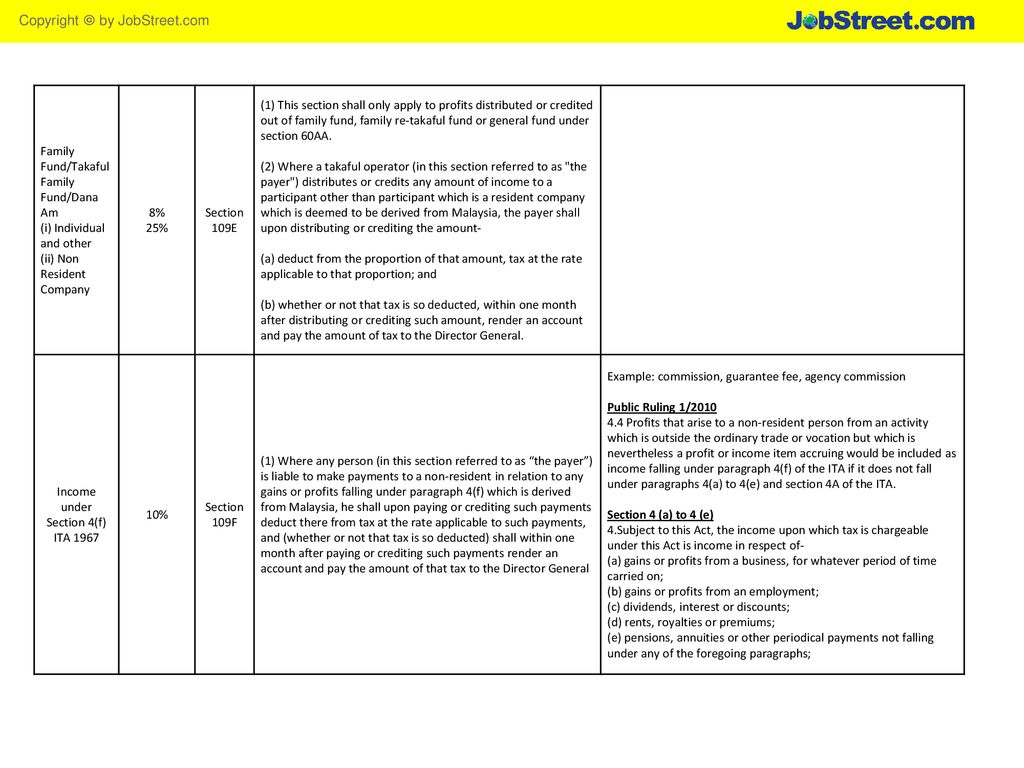

Income Under Section 4 F Ita 1967

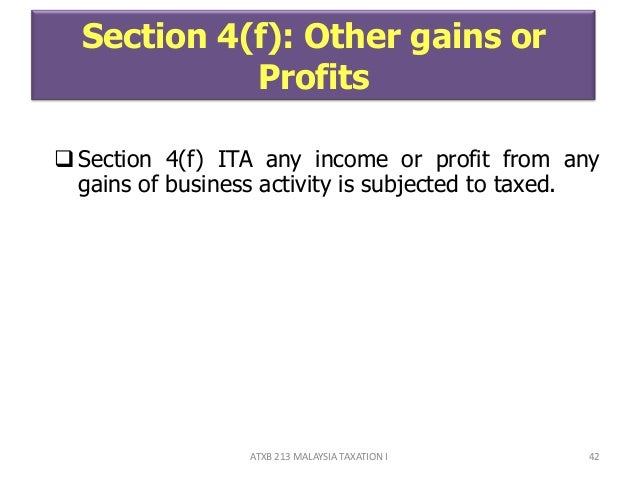

F gains or profits not falling under any of the above.

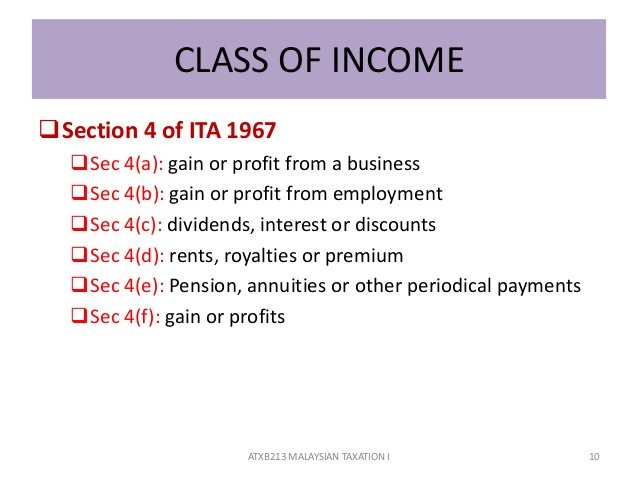

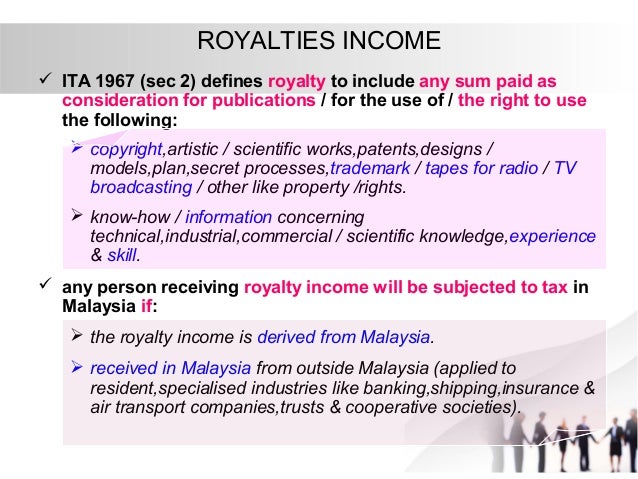

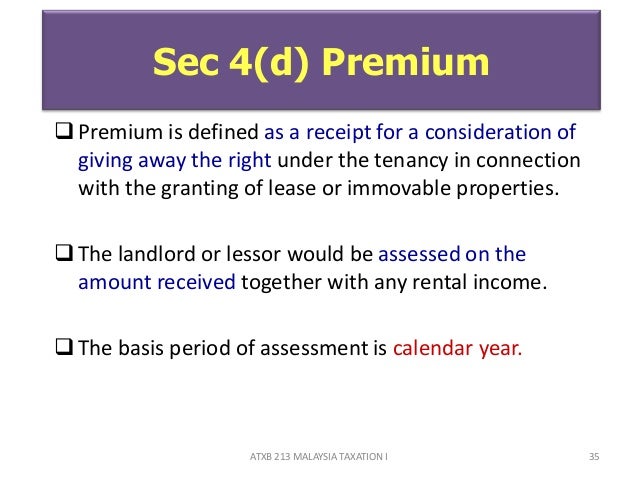

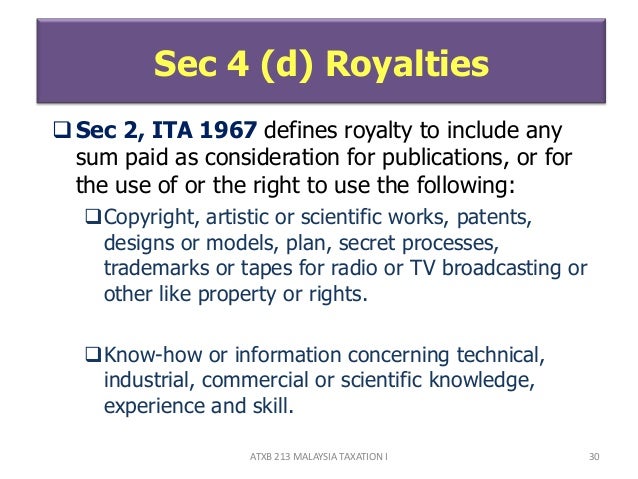

Income under section 4 f ita 1967. D rents royalties or premium. Charge of income tax 3 a. Classes of income on which tax is chargeable 4a. Income under section 4 f ita 1967.

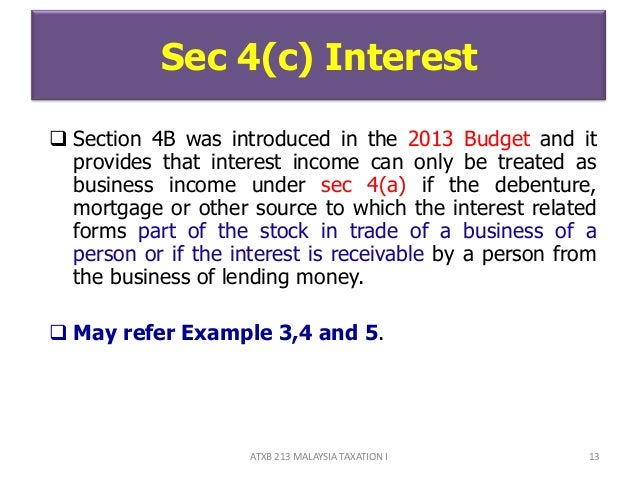

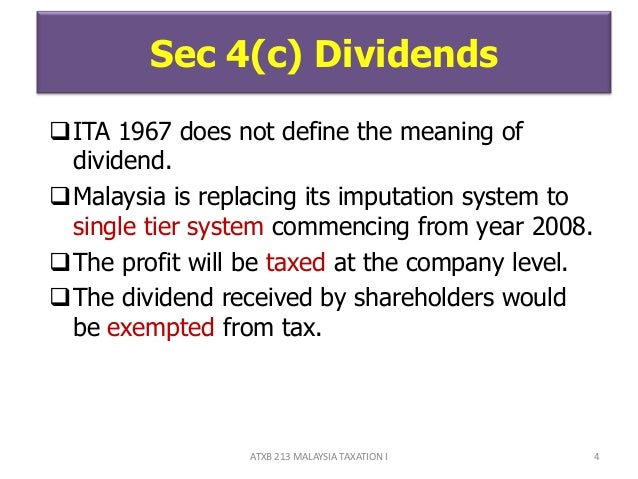

Income tax act 1967 arrangement of sections part i preliminary section 1. Non chargeability to tax in respect of offshore business activity 3 c. C dividends interest or discounts. The provisions of the ita related to this ruling are paragraphs 4 f 6 1 k sections.

A gains or profits from a business. A provision of personnel for advisory or supervisory services example 2 a sdn bhd buys a power plant from b ltd a non resident company. Non chargeability to tax in respect of offshore business activity 3c deleted 4. B gains or profits from an employment.

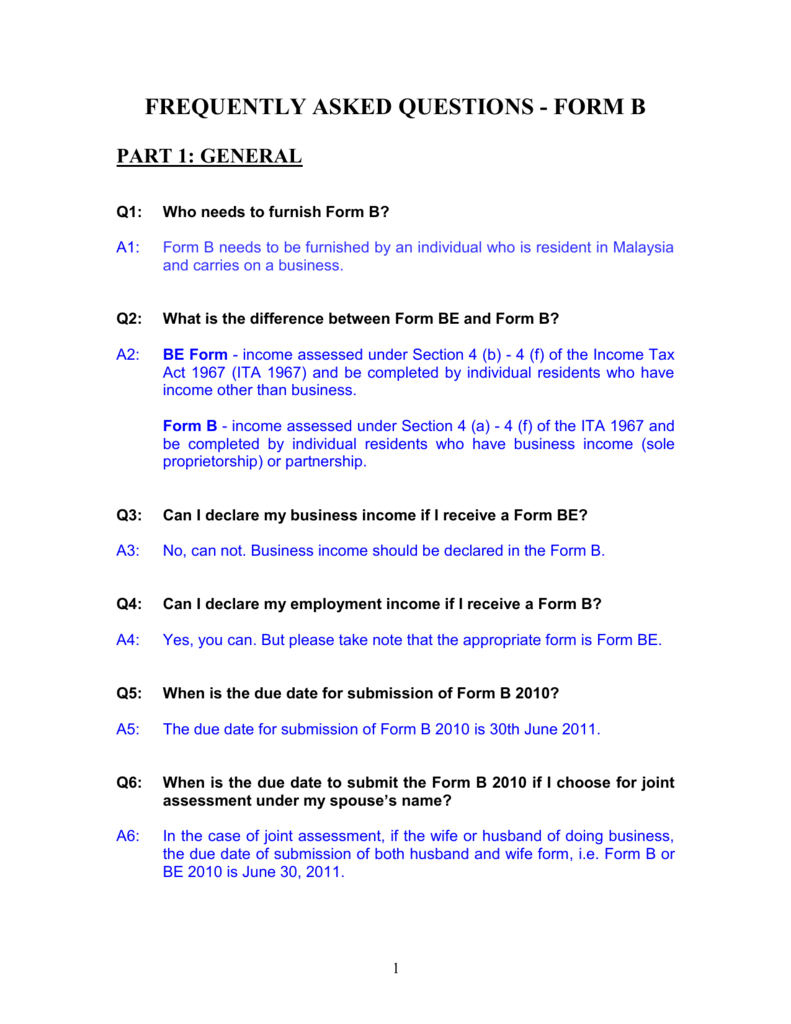

Short title and commencement 2. Akta cukai pendapatan 1967 is a malaysian laws which enacted for the imposition of income tax. Act 1967 ita 1967 and be completed by individual residents who have income other than business. And c the responsibility of deducting and remitting tax deducted from such income.

Under section 107a of the ita 1967 applies. The income tax act 1967 malay. All withholding tax payments other than for non resident public entertainers must be made with the relevant payment forms duly completed together with copy of invoices issued by the nr payee and copy of payment documents as proof of date of payment crediting to the nr payee. Income under section 4 f ita 1967.

Revolves around section 4 income tax act 1967 which defines income. Can i declare my business income if i receive a form be. This is due to the inadequacies of section 4 income tax act 1967 in effectively defining income. Interpretation part ii imposition and general characteristics of the tax 3.

Form b income assessed under section 4 a 4 f of the ita 1967 and be completed by individual residents who have business income sole proprietorship or partnership. Income tax act 1967 part i preliminary section 1. Income falling under section 4 f of the income tax act 1967 ita 1967 includes any other income that is not obtained from business employment dividends interests discounts rents royalties premiums pensions or annuities. Short title and commencement 2.

The income tax act 1967 in its current form 1 january 2006 consists of 10 parts containing 156 sections and 9 schedules including 77 amendments. Perusing the cases involving income tax it is obvious that most of the cases revolve around issue of what constitutes income. Classes of income section 4 of the income tax act 1967 as amended ita. B the deduction of tax from such income.

Interpretation part ii imposition and general characteristics of the tax 3. 7 2 the following are examples of services that generate income falling within the scope of paragraph 4a i of the ita 1967. A the income of a non resident person who is chargeable to tax under paragraph 4 f of the income tax act 1967 ita. Classes of income on which tax is.