Malaysian Taxation Question And Answer

Download the piece by our subject matter experts.

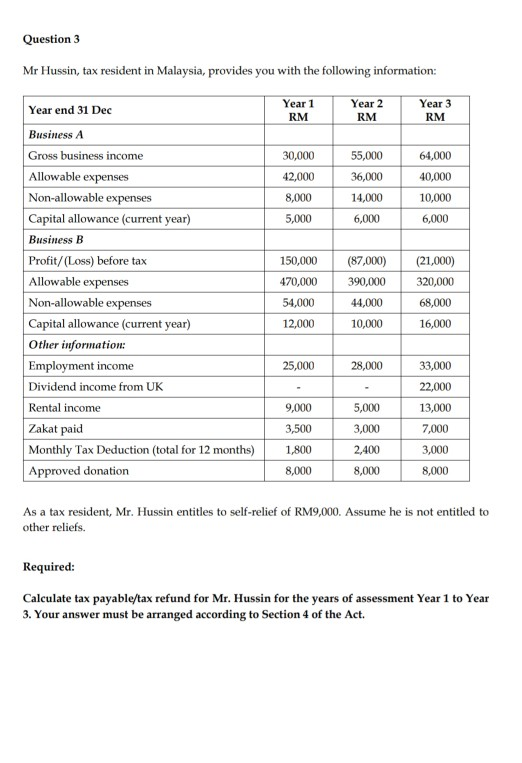

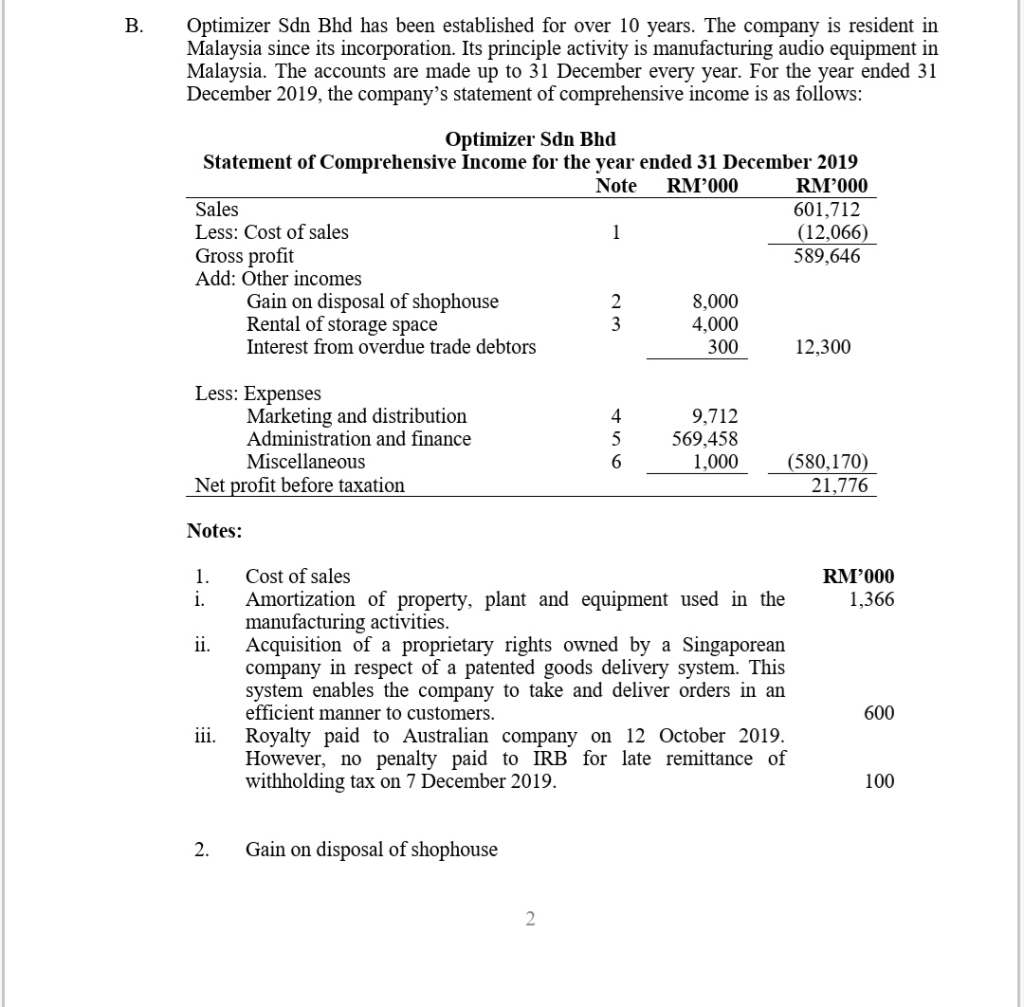

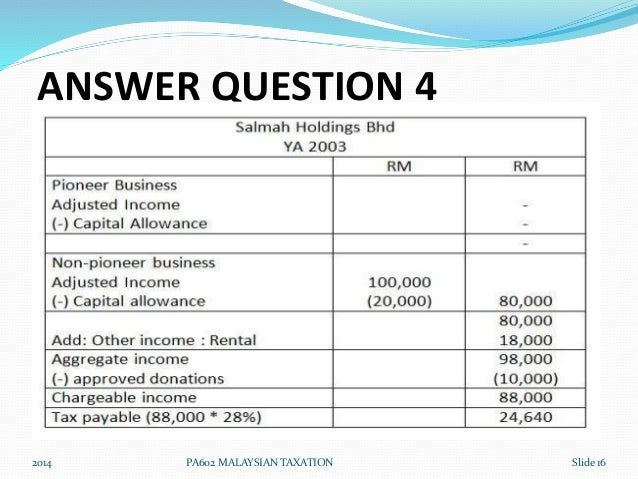

Malaysian taxation question and answer. Even after gst should people need to pay income tax. Deloitte malaysia s panel of tax partners share their insights and analysis ahead of budget 2021 announcement through a series of questions and answers. This booklet also incorporates in coloured italics the 2020 malaysian budget proposals announced on 11 october 2019 and the finance bill 2019. 13 september 2018 time.

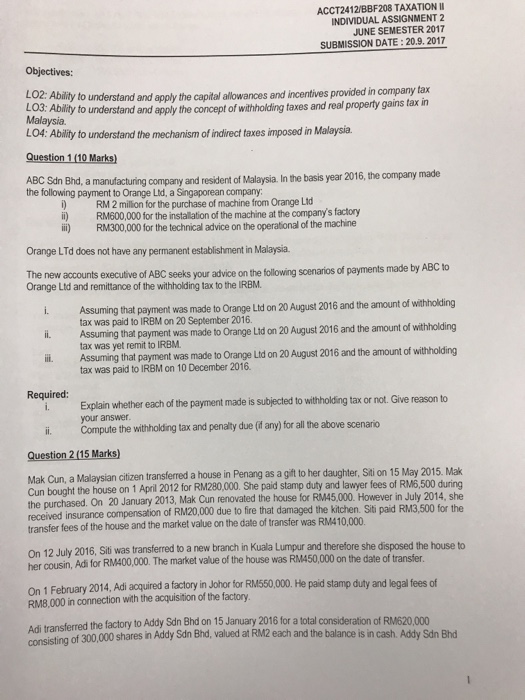

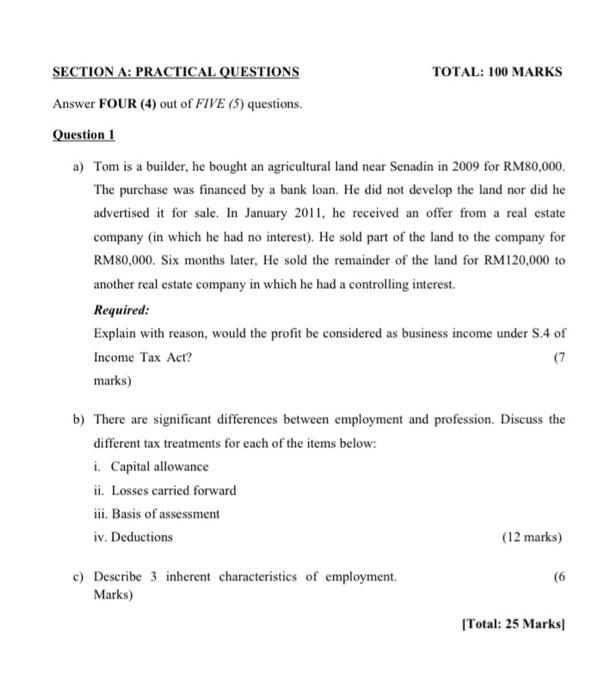

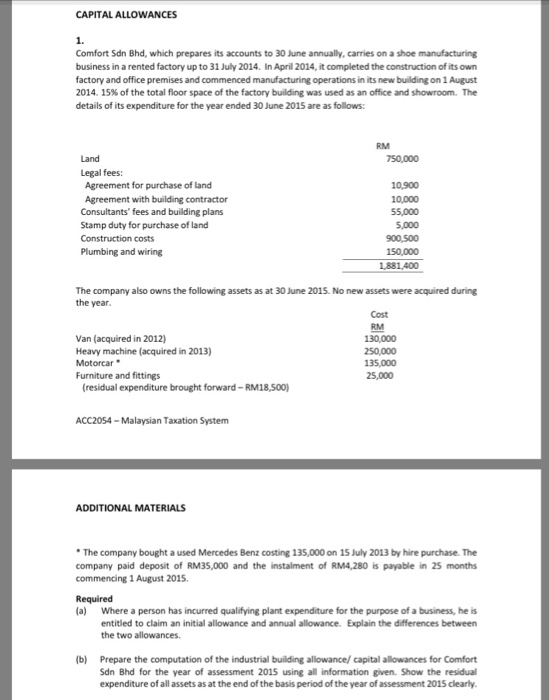

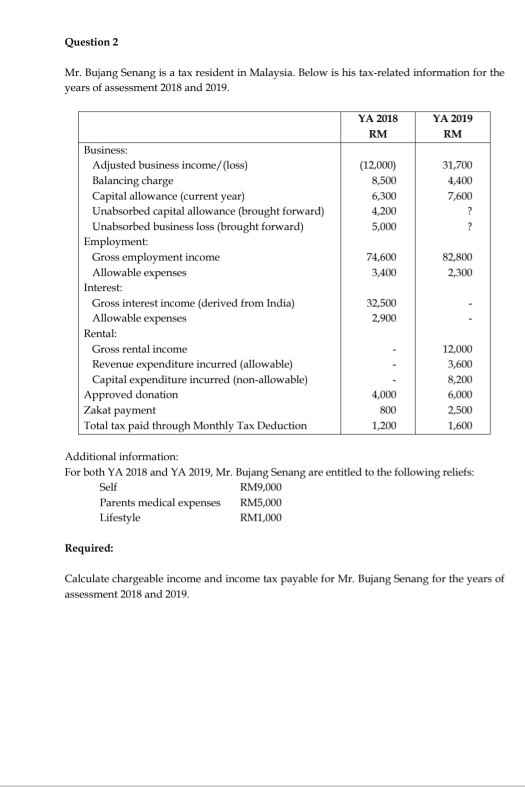

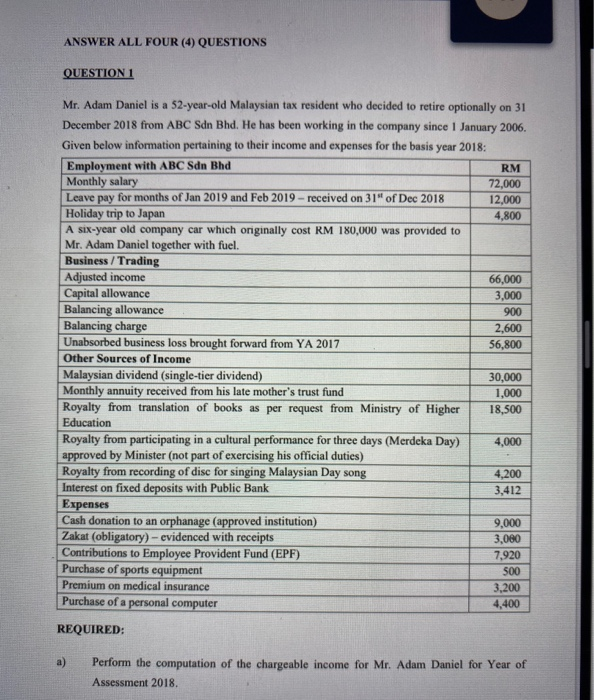

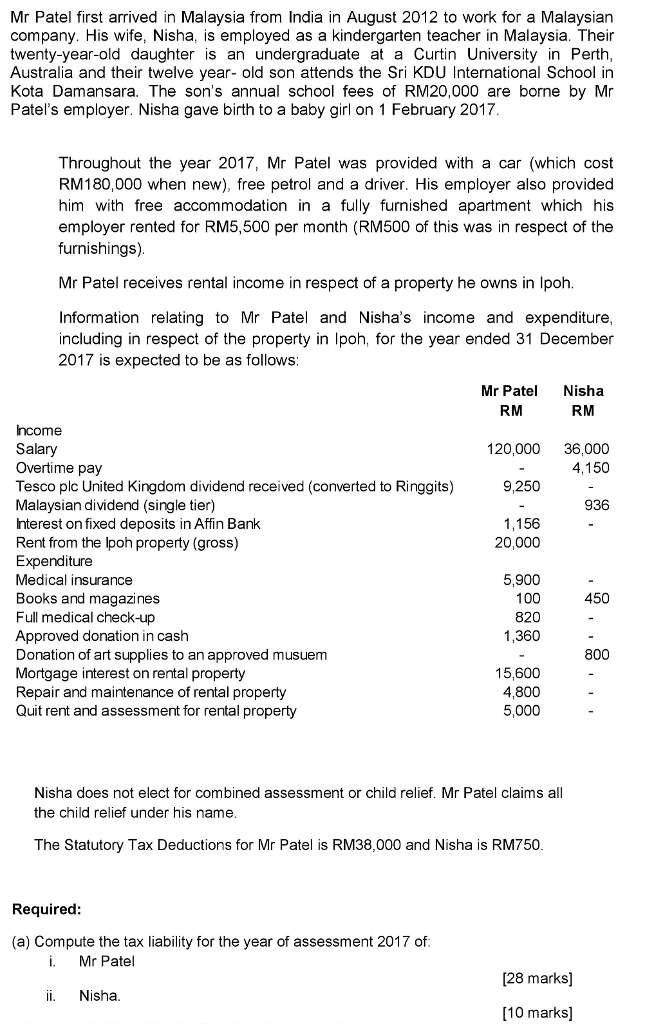

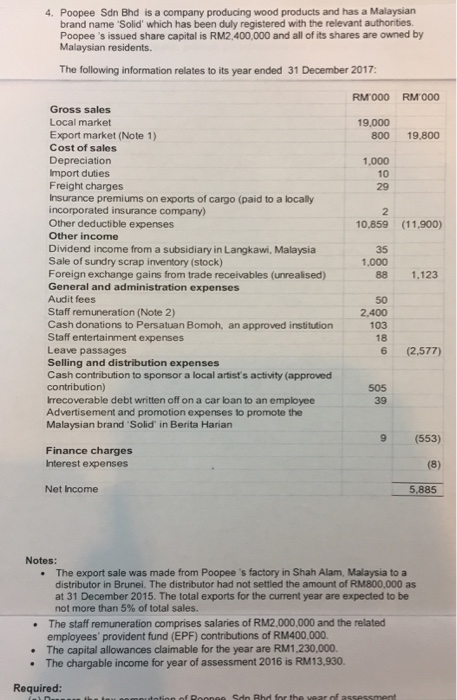

15 minutes writing. Solved 25 tax questions and answers section with explanation for various online exam preparation various interviews logical reasoning category online test. These proposals will not become law until their enactment and may be amended in the course of their passage through. This question paper contains 6 questions on 15 printed pages.

In malaysia double taxation usually happens when a taxpayer of malaysia engages in international or cross border business transactions within the territory of another country. 2 15 pm 5 30 pm reading and planning. Therefore income tax would continue to apply on the income of individuals and businesses as is being applied presently. All references to legislation or public rulings shown in square brackets are for information only and do not form part of the answer expected from candidates.

This publication is a quick reference guide outlining malaysian tax information which is based on taxation laws and current practices. 3 hours instructions to candidates. A free inside look at tax interview questions and process details for 15 companies in malaysia all posted anonymously by interview candidates. To view pdfs of past exam papers for malaysia please select from the list below.

Category questions section with detailed description explanation will help you to master the topic. Answer questions 1 2 and 3 in separate booklet s from questions 4 5 and 6. To practice tx mys exams in the cbe environment you can access the june september and december 2019 sample questions and answers.