What Is Share Premium In Equity

There are three main steps used to calculate the equity risk premium.

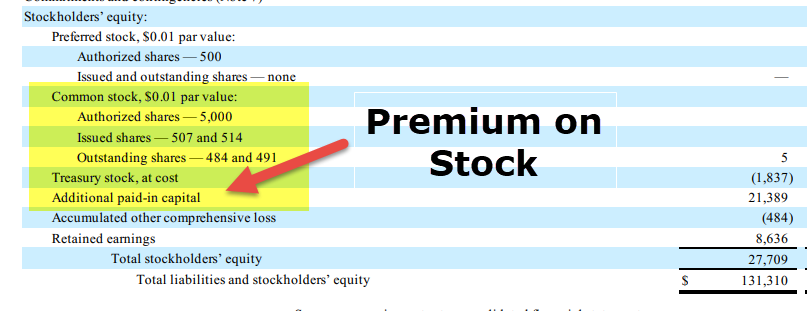

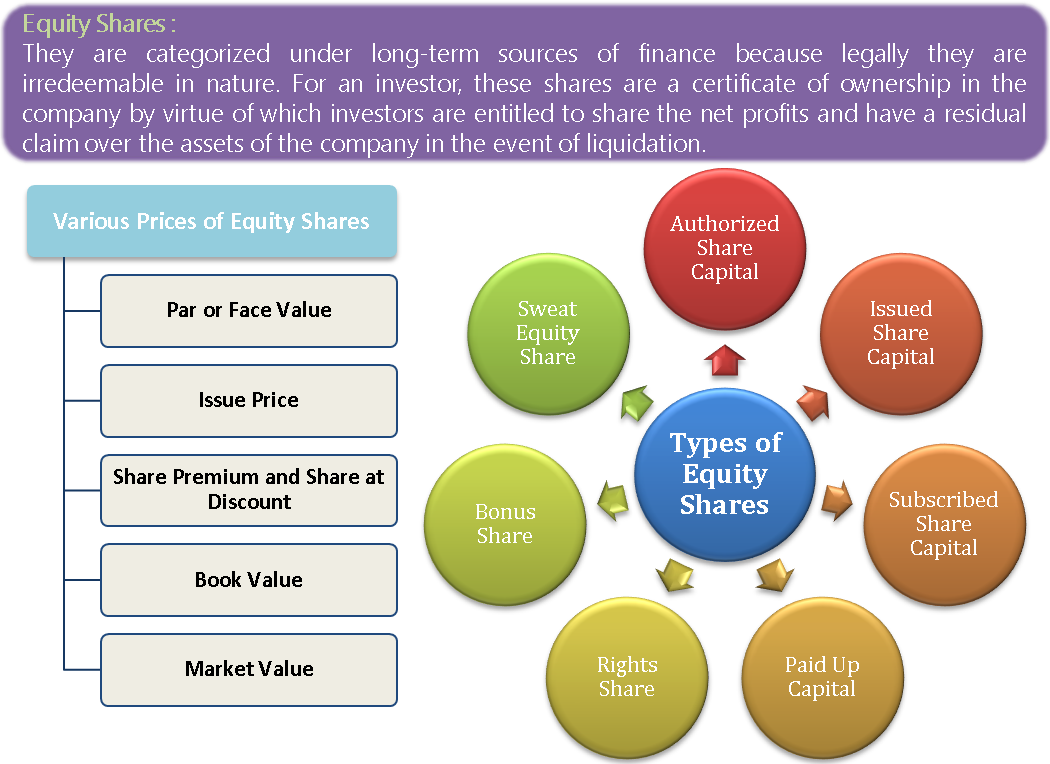

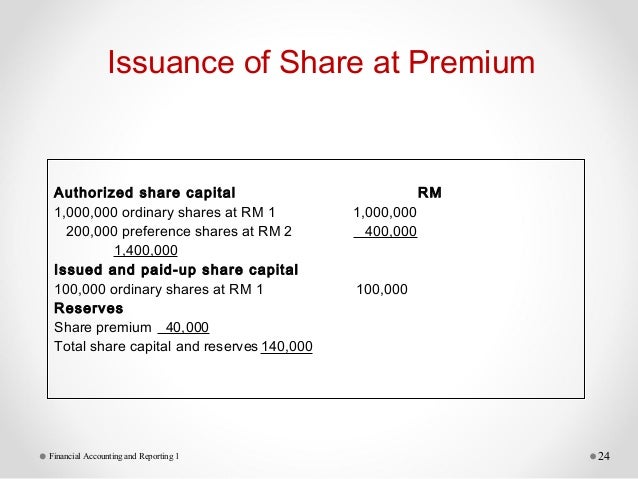

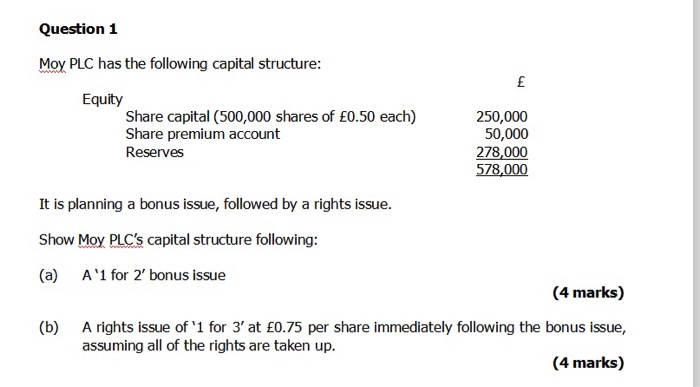

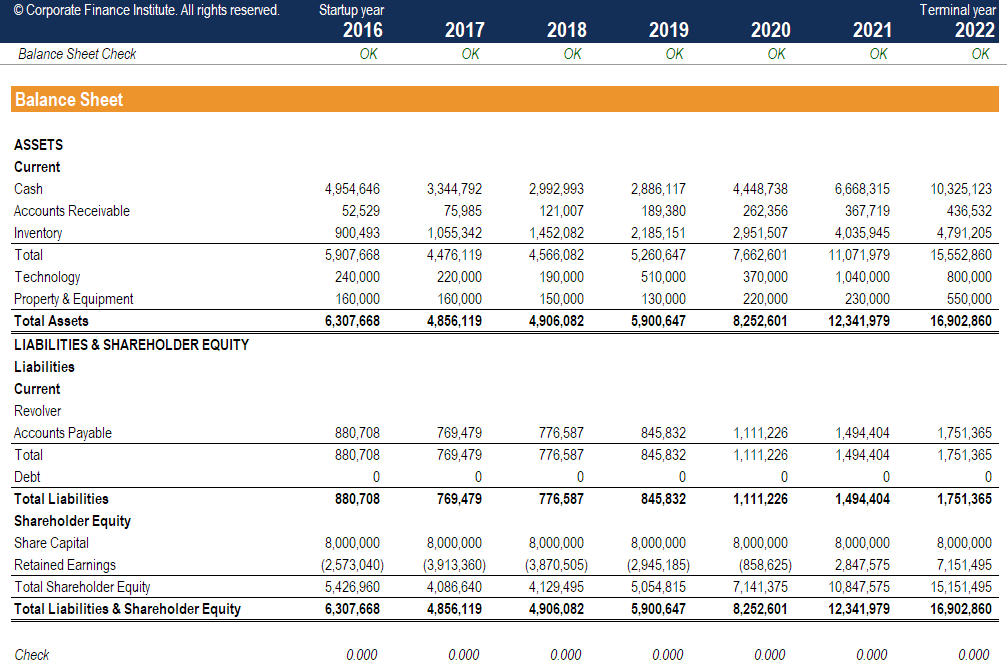

What is share premium in equity. Equity premium is also known as equity risk premium. It can also be used to issue bonus shares to the shareholders. Thus the company has 4 500 in equity capital. The amount of share premium is presented in the balance sheet as part of the equity.

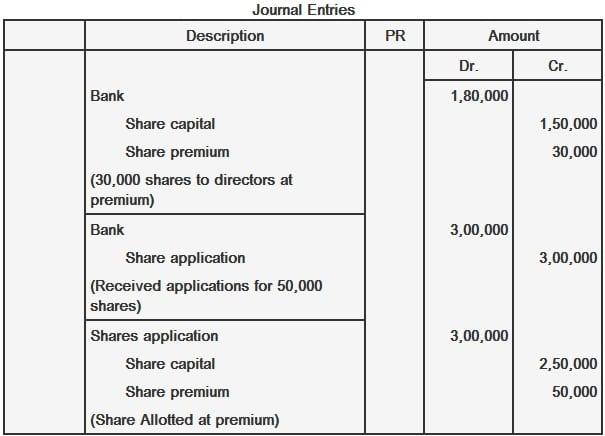

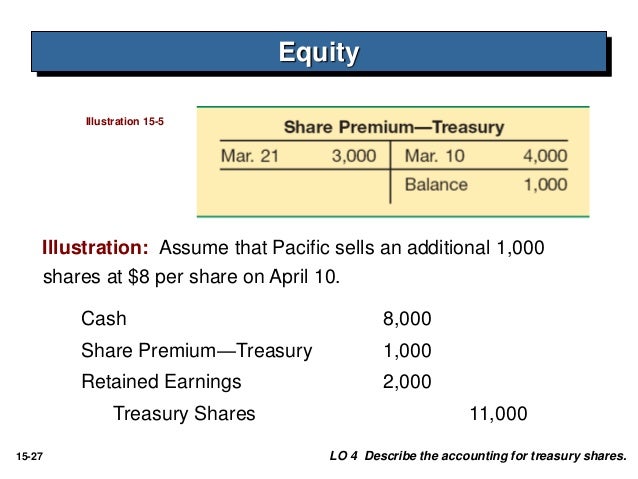

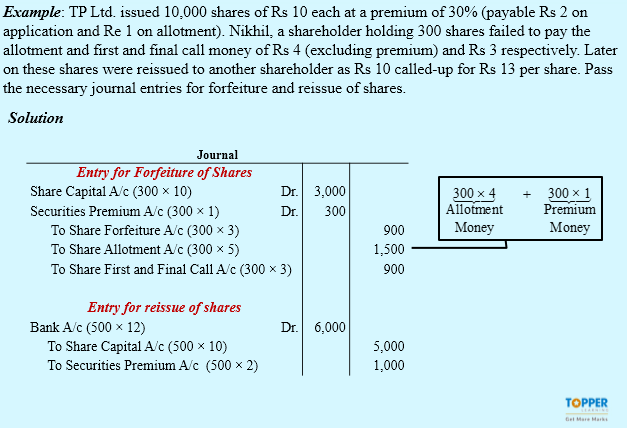

For example five years ago when a uk limited company was registered it issued 100 shares for 1 each their nominal value. Share premium market value vs. The costs and expenses relating to issuance of new shares can also be paid from the share premium. Share premium can only be used for certain specific purposes that are laid out in the corporation s bylaws.

It is the excess return that one gets when investing in the stock market over the return from a risk free rate. A share premium is the amount paid for an equity in excess of its nominal value that is. The premium varies with the level of risk involved and it changes as the market fluctuates. Of this 4 500 only 3 000 is share capital the remaining 1 500 is share premium representing funds generated from shareholders as a return for.

Its market value less its book cost. A share premium account shows up in the shareholders equity portion of the balance sheet. Share premium can usually be used for paying equity related expenses such as underwriter s fees.