What Is Share Premium Reserve

An unearned premium reserve is maintained on an insurer s balance sheet to reflect the unearned premiums that would be returned to policyholders if all policies were canceled on the date the balance sheet was prepared.

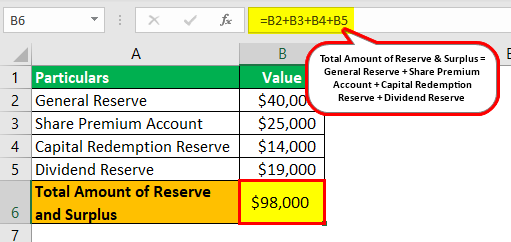

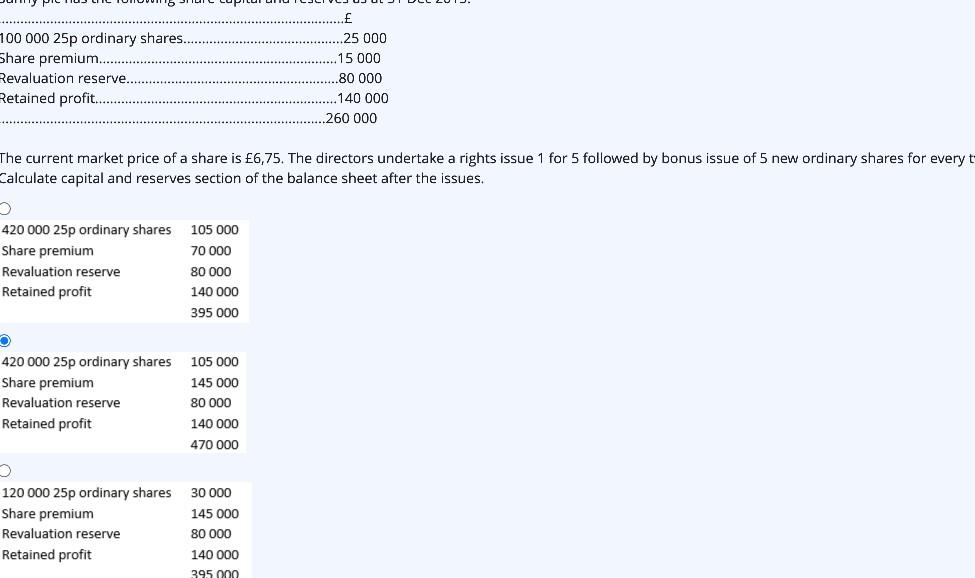

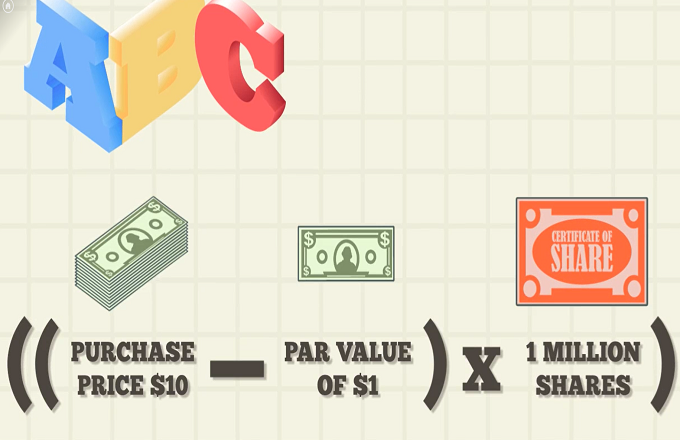

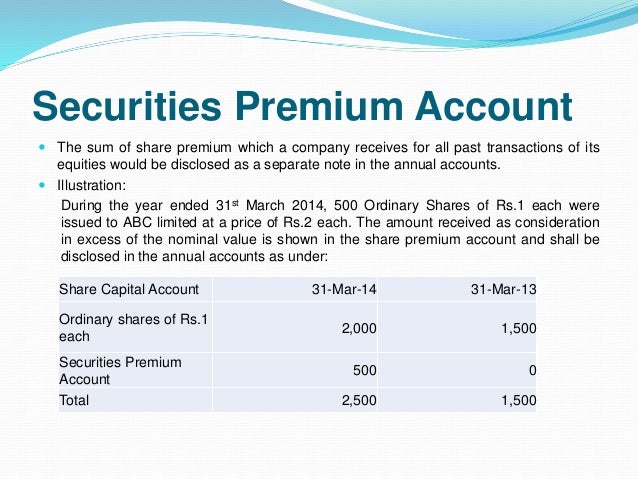

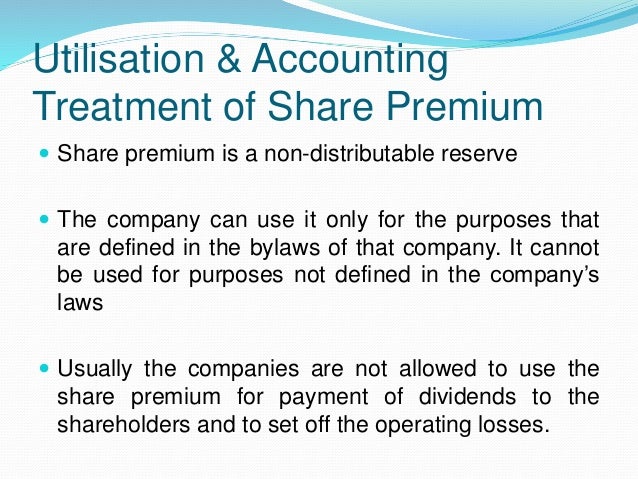

What is share premium reserve. Share premium is a non distributable reserve. Premium reserve insurers earn the premium paid for an insurance policy over the life of the policy. The share premium account is a reserve that cannot be distributed. For example if the company sells its share having a face value of 3 per share at the price of 5 per share then the share premium reserve is 2 per share.

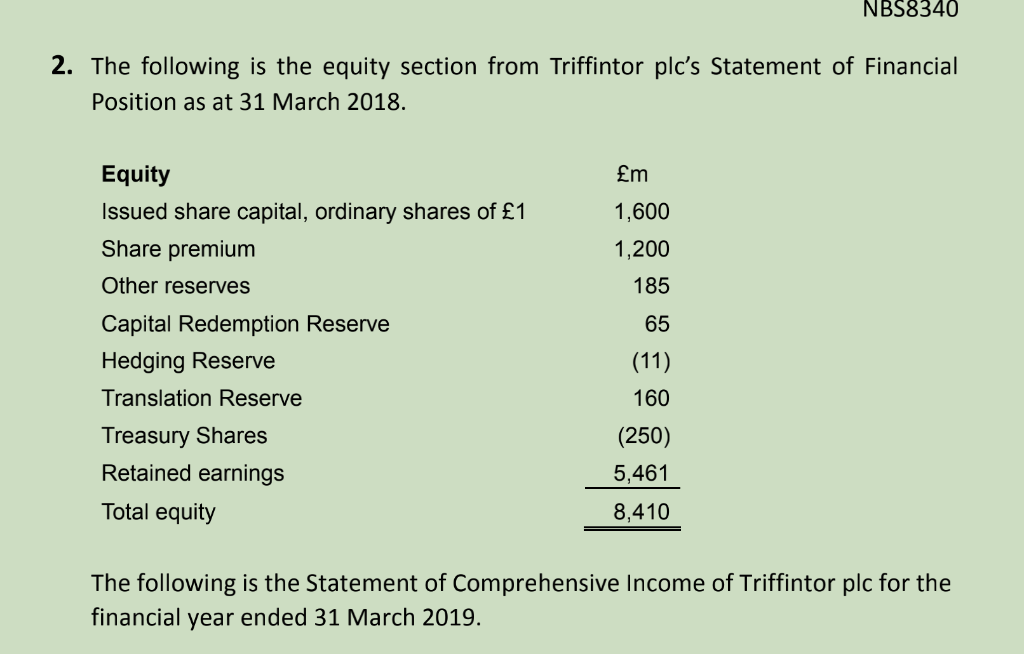

Issuing shares at a premium is a commonly used practice as par value is often set at a minimum level and does not reflect the. In other words one twelfth of an annual premium is earned each month. Also note that the. The provisions relating to the share premium account are set out in section 610 of the companies act 2006.

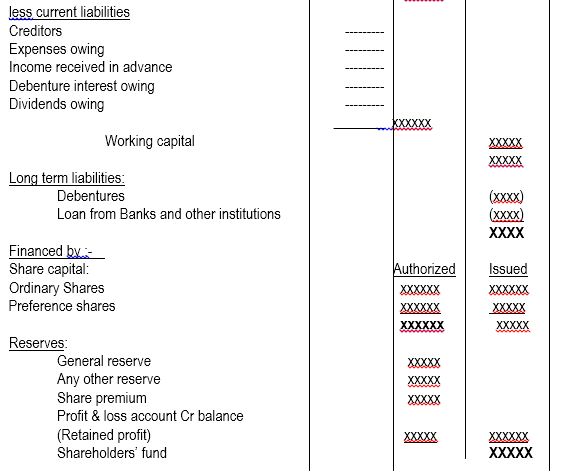

Share premium is the credited difference in price between the par value or face value of shares and the total price a company received for recently issued shares. Subject to the companies articles the share premium account may be. D in providing for the premium payable on the redemption of any redeemable preference shares or of any debentures of the company. C in writing off the expenses of or the commission paid or discount allowed on any issue of shares or debentures of the company.

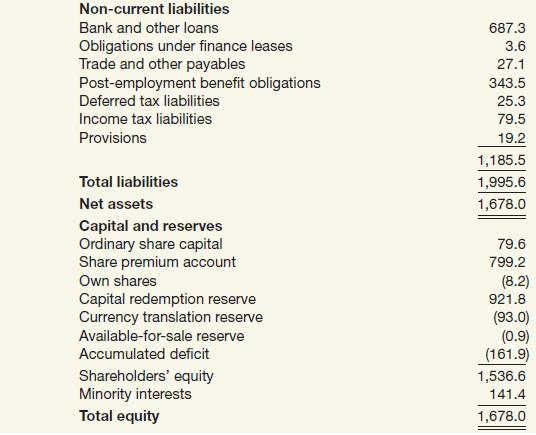

Treasury shares are deducted from equity. Reserves include retained earnings together with reserves such as fair value reserves hedging reserves asset revaluation reserves and foreign currency translation reserves and other statutory reserves. Share premium is the additional amount of funds received exceeding the par value of security. A company can use the balance of the account only for purposes that have been established in its bylaws.

It is a statutory reserve which forms part of a company s non distributable reserves. Or e for the purchase of its own shares or other securities under section 68. It cannot be used for purposes not defined in the company s laws. Simply it is the gain to the investor.

/GettyImages-592232681-ea1825e3f6c24e15b2514cd860fb3dbd.jpg)