How To Reduce Company Tax Payable In Malaysia

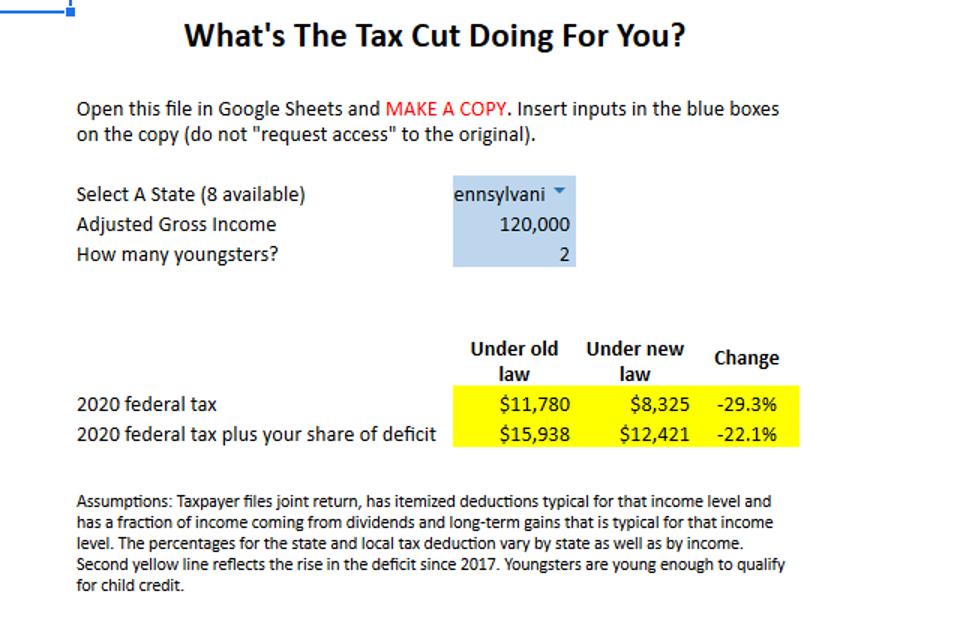

This would enable you to drop down a tax bracket lower your tax rate to 3 and reduce the amount of taxes you are required to pay from rm1 640 to rm585.

How to reduce company tax payable in malaysia. For example you are allowed to deduct the cost of acquiring machinery and equipment in full upfront up to a set dollar amount. There are several ways for how to reduce taxable income by being strategic about your business expenditures. If the employer pays for fuel the tax payer is taxed an additional rm 1200 for this bik. According to the public ruling for biks the tax payer must pay rm 3600 in taxes every year for a car worth rm 75000.

With effect from y a 2008 where a sme first commences operations in a year of assessment the sme is not required to furnish an estimate of tax payable or make instalment payments for a period of two years beginning from the year of assessment in which the sme. Whether you benefit from a company car depends on the value of the car and your current tax bracket. Starting from malaysia income tax year of assessment 2014 tax filed in 2015 taxpayers who have been subjected to mtd are not required to file income tax returns if such monthly tax deductions constitute their final tax. Light will be shed on the complexities of the laws governing property investments and you will be advised how to minimise your tax exposure legally so that you don t give tips to the government.

Melayu malay 简体中文 chinese simplified estimate of tax payable in malaysia. Make smart tax elections. Apply for specific industry tax incentive such as msc status. I n my book we will explore how taxation notably income tax and real property gains tax rpgt affects each area of real estate investment in malaysia.

However if you claimed rm13 500 in tax deductions and tax reliefs your chargeable income would reduce to rm34 500. Please use the cp207 form payment slip which is provided together with the c form to make payment. If form cp204 is not furnished but the company has tax payable such final tax payable shall without any further notice be increased by 10 and that sum shall be recoverable as if it were tax due and payable under the income tax act. That s a difference of rm1 055 in taxes.

If the difference between the actual tax payable and the estimated tax payable is more than 30 a 10 penalty will be imposed on that difference. However they should still file if they want to reduce their taxable income through reliefs. Mtd as final tax. This page is also available in.

/tax-avoidance-vs-evasion-397671-v3-5b71dfc846e0fb0025e54177.png)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)